Reference no: EM131335728

COURSE PROJECT

FINANCIAL STATEMENT ANALYSIS

Learning Objectives

• Analyze a company's financial statements in terms of liquidity, profitability and long-term solvency, and cash flows from operations.

• Prepare in good form a written presentation of the results of the financial statement analysis.

• Apply basic technology tools including the internet, word processing and spreadsheet software.

• Research a public company's financial information on a financial services website or the company's website.

Requirements

(1) Select a company and print financial statements

Select a public corporation (other than a financial institution or utility such a telephone, electric or gas company), and find its financial statements.Avoid companies that show Net Losses in either of the last two years' income statements, balance sheet and statement of cash flows.

Submit the three financial statements for homework credit.

(2) Calculate selected ratios and obtain industry averages for comparison

For each of the six financial statement ratios listed below, use the Key Ratios form (Excel file) to calculate the ratio for the most recent year and for the prior year. Show the ratio or percentage with one decimal point, for example: "2.1", "15.7%" (Note that in most textbooks, some of the ratios call for averaging the beginning and ending balances. However, for this project, use only the year's ending balances.)

After calculating the ratio, find the industry ratio as shown in Moneycentral's "Key Ratios" under "Financial Results" and enter the industry ratio in the Industry Average column of the Key Ratios form. Notethat in Moneycentral's Key Ratios page there are six or seven groups of ratios in which these ratios might be contained. (It is likely that some of the Moneycentral's ratios for your company will be different from the ones you calculate. Yours may be correct even though different, but double-check to make sure you are using the correct figures in your calculation.)

(1) Current Ratio

(2) Accounts receivable turnover

(3) Inventory turnover (not applicable to service companies)

(4) Debt to Equity ratio

(5) Return on Equity

(6) Price earnings ratio (P/E Ratio) [Divide the current market price from a recent newspaper listing by the "basic" earnings-per-share shown on the most recent year's income statement.] Note that the Price/Earnings Ratio (PE Ratio) changes daily with the stock price.

Submit the completed Key Ratios form (Excel file) for homework credit.

(3) Using Microsoft Word, write a paper (12 pt font, single spaced) that describes the financial condition of the company based on the following items. Each of the items should have a sub-heading with corresponding numbers (a), (b), etc. in bold font.

A title page (no item number)

(a) A paragraph which describes the primary business activity of the company. Indicate the source from which you obtained that information.

(b) A table in the body of the Word document containing the financial statement ratios that you calculated for Requirement no. 2 but in the format shown below. (Place the Key Ratio form containing your calculations in theAppendix to your report.)

|

Key Financial Statement Ratios

|

|

|

Most Recent Year

|

Prior Year

|

Industry Average

|

|

Current Ratio

|

|

|

|

|

Accounts Receivable Turnover

|

|

|

|

|

Inventory Turnover

|

|

|

|

|

Debt to Equity Ratio

|

|

|

|

|

Return on Equity

|

|

|

|

|

Price Earnings Ratio

|

|

n/a

|

n/a

|

(c) A separate paragraph for each of the ratios listed above. Start each ratio paragraph with an underlined heading, such asCurrent Ratio. Each ratio paragraph should contain the following: (1) An explanation of what the ratio means and how a comparatively high or low figure should be interpreted.Obtain the interpretation of each from at least one research sourceother than the textbook. It is NOT necessary to state how the ratio is calculated. (2) Comment on the trend from the prior year to this year (refer to the ratio numbers for each of the two years) and indicate whether the trend is favorable or unfavorable). If the trend is unfavorable and continues to be unfavorable in future years, state what the possible impact might be to the financial condition of the company. (3) State how your company's most recent year compares with the average for its industry.

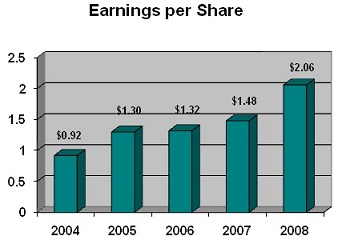

(d) Earnings Per Share trend is the principal benchmark for investors. Incorporate a bar graph(see example below) in your Word document showing Basic Earnings Per Share for the last three to five years. (Note that in Moneycentral, basic (normalized) EPS figures are shown at the bottom of the Income Statement.)

Below the graph, comment on the trend in EPS over the five year period.

(e) After commenting on each ratio individually, write a summary paragraph which presents your assessment of (1) the company's liquidity and debt situation, and (2) its profitability based on your analysis of the relevant profitability ratios.

(f) Present a table containing the most recent five years of cash flows from operating activities and cash flows from investing activities, as in the example below.

|

Year

|

2004

|

2005

|

2006

|

2007

|

2008

|

|

Cash Flow from Operating Activities (in $millions)

|

5,968

|

6,423

|

5,957

|

7,150

|

7,571

|

|

Cash Flow from Investing Activities (in $millions)

|

-503

|

-1,496

|

-1,700

|

-6,719

|

-2,363

|

Below the table, comment on the company's cash flows. Note that the ideal situation is for a company to show an upward trend in positive cash flows from operating activities, and that the positive cash flows from operating activities is sufficient to cover negative cash flows from investing activities. If there are unusual changes in cash outflows for investing activities, comment on what caused them.

Based on these criteria, state your opinion about the company's ability to generate a positive cash flow from its operations. If there are substantial fluctuations in cash flows from operating activities from one year to the next (a 20% increase or decrease could be considered substantial), analyze that section of the Statement of Cash Flows and comment on the apparent reason for such increase or decrease.

(g) List "References" in proper APA style on a separate page (see examplesat the end of this document.)

(h) In an Appendix to your report, provide the Key Ratio form that contains your ratio calculations.

(i) From the company's most recent 10-K filing in the SEC's EDGAR website, copy and paste into the project's Word file or into separate Excel worksheets within a single Excel file the company's balance sheet, income statement, and statement of cash flows, and include them in an Appendix to your report.

Writing quality and report format count:

Note that financial statements of large publicly held companies generally report dollars in millions. As an example, 621.4 is actually $621,400,000. When referred to in a sentence, it should be shown as "$621.4 million". Another example, $1,922,440 (million) is actually $1,922,440,000 (billion) and should be expressed in a sentence as "$1.9 billion".

Avoid "hype": Your comments about the company should be based only on the financial information you obtain from your research, not on any personal opinions you might have. Avoid referring to companies as "they", and avoid abbreviations and contractions such as "it's". Students for whom English is their second language and who are not able to write acceptably in English must engage an English tutor; the International Program Office may be able to furnish names of such tutors.

Avoid predictions or comments relating to the company's future. An analysis of financial statement ratios is not by itself sufficient to form a basis for future liquidity or profitability.

Oral presentations

The instructor may require an oral presentation of the report, and if so, will specify the length and other aspects of the presentation.

Refer to the Course Outline.Reports turned in late but prior to the Final Exam will be downgraded 10 percentage points. Reports will not be accepted after the Final Exam.

References

SAIC, Inc. (n.d.) Retrieved March 5, 2009 from https://moneycentral.msn.com

United States Securities and Exchange Commission.(n.d.). SAIC, Inc. Retrieved March

13, 2009 from https://www.sec.gov/Archives/edgar/data/1336920/000119312508067632/d10k.htm#fin90691_3

Wild, J. (2007).Financial Accounting Fundamentals.New York: McGraw-Hill.

MarketWatch.com (2009). Google, Inc. Profile.Wall Street Journal. Retrieved March 18, 2009, from https://www.marketwatch.com/tools/quotes/profile.asp?symb=GOOG

Moneycentral (2009).MSN Money.Retrieved on March 19, 2009, from https://moneycentral.msn.com/investor/invsub/results/statemnt.aspx?Symbol=US:GOOG Statement=Income&stmtView=Ann

Spiceland, D., Sepe, J., Nelson, M. &Tomassini, L. (2009).Intermediate Accounting.

New York: McGraw-Hill Irwin.