Reference no: EM131518655

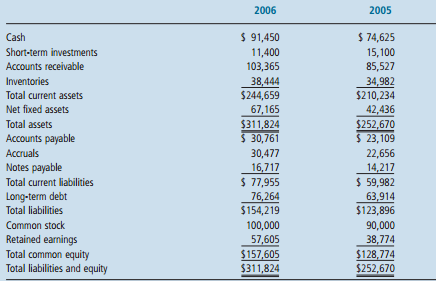

Question: Start with the partial model in the file IFM9 Ch07 P10 Build a Model.xls from the ThomsonNOW Web site. Cumberland Industries' most recent balance sheets (in thousands of dollars) are shown below and in the partial model in the file:

a. The company's sales for 2006 were $455,150,000, and EBITDA was 15 percent of sales. Furthermore, depreciation amounted to 11 percent of net fixed assets, interest charges were $8,575,000, the state-plus-federal corporate tax rate was 40 percent, and Cumberland pays 40 percent of its net income out in dividends. Given this information, construct Cumberland's 2006 income statement. (Hint: Start with the partial model in the file.)

b. Next, construct the firm's statement of retained earnings for the year ending December 31, 2006, and then its 2006 statement of cash flows.

c. Calculate net operating working capital, total net operating capital, net operating profit after taxes, and free cash flow for 2006.

d. Calculate the firm's EVA and MVA for 2006. Assume that Cumberland had 10 million shares outstanding, that the year-end closing stock price was $17.25 per share, and its after-tax cost of capital (WACC) was 12 percent.