Reference no: EM13198461

Part A

Assume that you are a Financial Analyst working for Muscat Investment L.L.C. Evaluate the financial performance of a company listed in the Muscat Securities Market (MSM) by taking into consideration the following instructions.

Instructions:

i. Select a company from MSM (Other than Banking and Investment companies)

ii. Collect financial reports for five consecutive years.

iii. Use annual financial statements for analysis. Avoid using quarterly statements.

iv. Provide references for the data collected (use Coventry Harvard style of referencing). Company websites can also be used for data collection.

v. From the financial statements and additional information collected by you complete the below mentioned tasks.

TASKS

1. Compute the following ratios for each year.

a. Liquidity Ratios

b. Profitability Ratios

c. Efficiency Ratios

d. Capital Structure Ratios (Gearing)

e. Market Ratios (dividend, PE etc.)

2. On the basis of literature review and from the above computations analyse the performance of the company in terms of profitability, liquidity and efficiency.

3. As a Financial analyst, would you recommend buying this company shares. Why or why not? Discuss.

Part B:

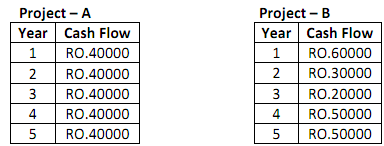

Q1. Gulf Oasis is considering two mutually exclusive projects. Both require an initial cash outlay of RO. 100,000 each. The estimated life of the both projects is five years. The company's required rate of return is 10%. The projects will be depreciated on a straight line basis. The

net cash flows expected to be generated by the projects are as follows:

a) Evaluate the proposals by:

i. Net present value method

ii. Internal rate of return method

iii. Profitability index method

On the basis of these measures (calculations) only, which project would you recommend? (Calculations 10 marks; recommendations on the basis of calculations 5 marks; Total: 15 marks)

b) What non-financial factors, would you consider while deciding between projects? On the basis of literature review, justify your recommendations.

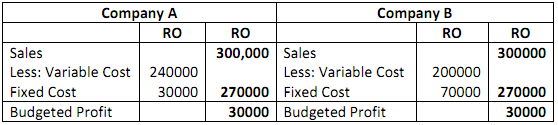

Q2. Two businesses Company A and Company B sells the same type of product in the same type of market. Their budgeted Profit and Loss Accounts for the coming year are as follows:

You are required to:

(a) Calculate break - even point of each business

(b) Calculate the sales volume at which each business will earn RO.5000 profit

(c) Calculate margin of safety of each business

(d) State which business is likely to earn greater profit in condition of:

(i) Heavy demand for the product

(ii) Low demand for the product

Briefly give your reasons

|

How far apart are the parallel sides

: A trapezium with an area of 168cm squared has parallel sides of lengths 6cm and 18cm.

|

|

It is measured eastward in units of time

: Polaris is almost at +90 degrees. Stars passing your zenith have a declination equal to your local latitude. Its origin is the celestial equator. It is measured eastward in units of time

|

|

Describe the behavior of labor markets

: People from the countryside, especially from minority tribes, move to the vibrant cities, earn what they felt they need and return to the countryside, returning more quickly the more they earn per hour.

|

|

Evaluate impact of the starting discovery in terms of supply

: Many nutritionist regard tofu as virtually a wonder food. Imagine now that yet another benefit of tofu is discovered. Mixed with a few cheap ingredients it greatly increase gasoline mileage just as it enhances performance in humans.

|

|

Calculate margin of safety of each business

: Calculate break - even point of each business, calculate the sales volume at which each business will earn RO.5000 profit and calculate margin of safety of each business

|

|

What kind of competitive structure would you like to see

: We have discussed several ways in which industries are organized. Now imagine a newly emerging industry, perhaps born on the internet. Without knowing anything else about it.

|

|

Determain if hacking into a web site

: Determain if hacking into a web site is ever justifiable, applying your theory to a real-world case in which someone hacked into a system, including the name of the company and details.

|

|

Explain long-run adjustment that will take place in industry

: Suppose that the market for the services of hookah bars is in long-run equilibrium. (1) more cities end regulations that had generated fixed costs for hookah bars, and (2) many nonstudent adults discover previously unknown preferences for the serv..

|

|

Use to gain attention

: Regardless of what other methods you use to gain attention, you should always relate the topic to your audience in the introduction of a speech.

|