Reference no: EM131522476

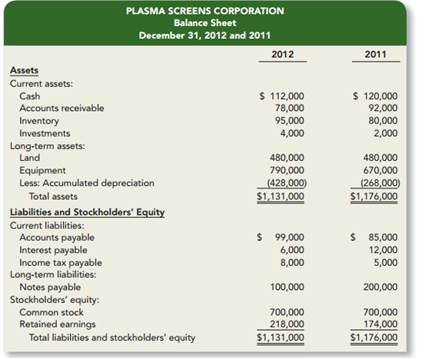

Question: The balance sheet for Plasma Screens Corporation and additional information are provided below.

Additional Information for 2012:

1. Net income is $69,000.

2. Sales on account are $1,520,000.

3. Cost of goods sold is $1,160,000.

Required: 1. Calculate the following risk ratios for 2012:

a. Receivables turnover ratio.

b. Inventory turnover ratio.

c. Current ratio.

d. Acid-test ratio.

e. Debt to equity ratio.

2. When we compare two companies, can one have a higher current ratio while the other has a higher acid-test ratio? Explain your answer.