Reference no: EM13729278

Question 1:

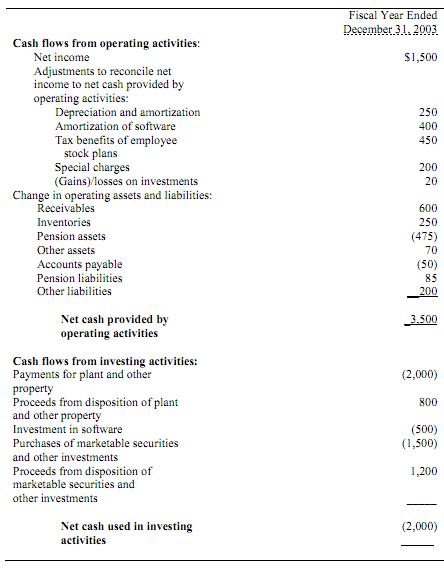

Below is an excerpt from the cash flow statement of a firm for fiscal year 2003:

Required:

a. Calculate free cash flow for 2003.

b. Calculate net payments to debt holders and issuers for 2003.

c. Calculate comprehensive income for 2003.

Question 2:

Part A

The following is a condensed version of the statement of shareholders' equity for Dell Computer Corporation for fiscal year ending January 31, 2003 (in millions of dollars):

|

Balance at February 1, 2002

|

4,694

|

|

Net income

|

2,122

|

|

Unrealized gain on debt investments

|

26

|

|

Unrealized loss on derivative instruments

|

(101)

|

|

Foreign currency translation gain

|

4

|

|

Comprehensive income

|

2,051

|

|

Shares issued on exercise of options, including tax benefits of $260

|

418

|

|

Repurchase of 50 million shares

|

(2,290)

|

|

Balance of January 31, 2003

|

4 )371

|

Other information:

1. Dell's tax rate is 35%

2. The repurchase occurred when the stock traded at $28 per share.

Required:

Prepare a reformulated statement of shareholders' equity for 2003 for Dell Computer Corporation. The reformulated statement should identify comprehensive income.

Part B

The following is extracted from Dell's balance sheet at January 31, 2003 (in millions of dollars):

Net financial assets 9,167

Common equity (2,579 million shares outstanding) 4,873

Analysts are forecasting consensus earnings per share of $1.01 for the year ending January 31, 2004.

a. Calculate net operating assets at January 31, 2003.

b. Net financial assets are expected to earn an after-tax return of 4% in 2004. What is the forecast of operating income implicit in the analysts' eps forecast?

c. Forecast the residual operating income for 2004 that is implicit in the analysts' forecast. Use a required annual return for operations of 9%.

d. Dell's shares are currently trading at $34 each. With the above information, value the shares under the following set of scenarios using residual income methods:

(i) Sales will grow at 5% per year after 2004.

(ii) Operating assets and operating liabilities with both grow at 5% per year after 2003.

(iii) Operating profit margins (after tax) will be the same as these forecasted for 2004.

e. Under the same scenarios, forecast free cash flow for 2004.

f. Under the same scenarios, forecast abnormal growth in operating income for 2005.

g. Show that, with a long term growth rate of 5%, the following formula will give the same value as that in part (d) of the question:

V0E = OI1x 1/0.09[G2 - g/1.09 - g] + net Financial Assets

where G2 is the (one plus) cum-dividend growth rate in operating income two years ahead and g is (one plus) the long-term growth rate.

|

Cash flows in the capital budgeting analysis

: What is the annual depreciation expense that Monkey Manufacturing may claim against taxable income under each of the three travel options - What is the net salvage value that Monkey Manufacturing can expect to receive

|

|

Explain the marketing communications objectives

: Case Study: The information in the Case Study is used each week when writing the individual sections of the Marketing Communications Plan. Explain the marketing communications objectives

|

|

Expect to earn an average return

: Janice plans to save 75$ per month, starting today, for 20 years. Kate plans to save 80$ a month for 20 years, starting one month from today. Both Hanice and kate expect to earn an average return of 5.5 percent on their savings. At the end of the 20 ..

|

|

Define the maximum number of doughnuts

: Describe what would be the capacity of the doughnut production operation that you are envisioning. In other words, describe what would define the maximum number of doughnuts that you could produce per hour.

|

|

Calculate free cash flow for 2003

: Calculate free cash flow for 2003 and calculate net payments to debt holders and issuers for 2003.

|

|

Explain strategies for eliminating the inefficiencies

: Describe ways in which the inefficiencies that you have identified could be reduced or eliminated. Define what changes would be required to job designs in order to implement your suggested strategies for eliminating the inefficiencies.

|

|

Differing line of business use different costs of capital

: Jenkins Security has learned that a rival has offered to supply a parking garage with security of ten years for $40,000 up front and a further $20,000 per year. Different division with differing line of business use different costs of capital becaus..

|

|

Coupon bond that pays semi-annual interest is reported

: A coupon bond that pays semi-annual interest is reported in the Wall Street Journal as having an ask price of 108% of its $1,000 par value. If the last interest payment was made 2 months ago and the coupon rate is 5.10%, the invoice price of the bond..

|

|

The constant-growth dividend discount model

: The constant-growth dividend discount model (DDM) can be used only when the ___________.

|