Reference no: EM13311411

1. On January 1, 2012, St. John Corp. purchased a new truck for $35,000. St. John determined that this truck would be useful for 150,000 miles at which time it would have a salvage value of $5,000. During the next three years the truck was driven for 25,000, 20,000, and 28,000 respectively. At the beginning of the fourth year (2015), St. John had to overhaul the truck's engine at a cost of $7,000. The overhaul increased the life of the truck by adding 20,000 miles of use. During the fourth year the truck was driven for 23,000 miles.

Required:

a) Calculate depreciation expense for the first three years. (2012, 2013, 2014)

b) Calculate depreciation expense for 2015. (Round to three decimals for calculating. Final answer should be rounded to nearest dollar.)

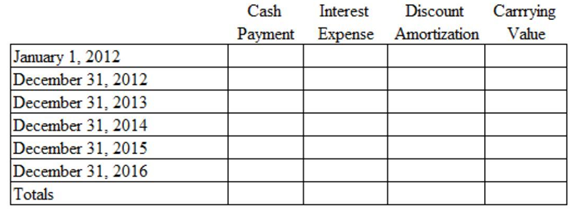

2 . Villarente Company issued 5-year $200,000 face value bonds at 95 on January 1, 2012. The stated interest rate on these bonds is 9%, and the effective interest rate is 10.33%. Use the effective interest rate method to complete the amortization schedule below. (Round all calculations to nearest dollar, i.e. do not show any decimals in table. You need to round the entries on 12/31/16. As check figures, total interest expense should be $100,000 and total discount amortization should be $10,000)

|

Use test driven development as you build your website

: In this project, you will create a simple personal website. First, create a machine at ICSFlexcloud. Setup the whole RoR environment. Following chapter 1-5 of the Rails tutorial, create your own styling using CSS for your website.

|

|

Find the normal force on the sled due to the hill

: A 29 kg sled starts from rest at the top of a frictionless hill inclined at an angle of 20 degrees to the horizontal. find the normal force on the sled due to the hill

|

|

Ability to exercise significant influence over the invest

: On January 3, 2013, Matteson Corporation acquired 30 percent of the outstanding common stock of O'Toole Company for $1,209,000. This acquisition gave Matteson the ability to exercise significant influence over the investee.

|

|

Explain carbon and silicon belong to the same group

: Carbon and silicon belong to the same group and are known to have similar properties. Do you think that silicon can replace the role that carbon plays in organic chemistry

|

|

Calculate depreciation expense for 2015

: Calculate depreciation expense for the first three years and calculate depreciation expense for 2015

|

|

Find the minimum rotations per second the cylinder must make

: A popular amusement park ride looks like a huge cylinder of radius 2.3 m, where people stand up along the vertical walls on top of a floor which can drop away. find the minimum rotations per second the cylinder must make

|

|

Explain what volume of a 15.0% by mass naoh solution

: what volume of a 15.0% by mass NaOH solution, which has a density of 1.116 g/mL, should be used to make 5.3 L of an NaOH solution with a pH of 10.0

|

|

How far did they skid

: A 1000 kg aircraft going 25 m/s collides with a 1500 kg aircraft that is parked and they stick together after the collision. how far did they skid

|

|

Explain methane undergoes the combustion

: Methane undergoes the combustion, as shown in the chemical equation below. Using bond energies, estimate the energy change for this reaction. Please use the correct bond energy for the CO bond in CO2

|