Reference no: EM131172203

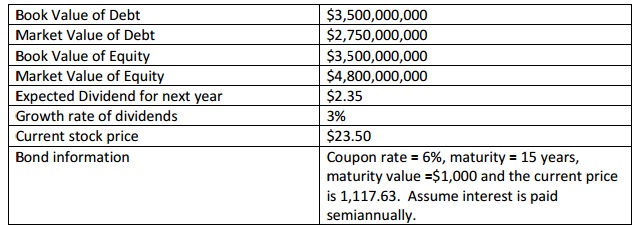

1. We are evaluating a project that costs $1,850,000, has a six-year life and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 92,000 units per year. Price per unit is $43.25, variable cost per

unit is $22.50 and fixed costs are $950,000 per year. The tax rate is 35 percent and you have the following information about the capital structure of the firm. Do this problem in Excel and attach the spreadsheet.

a. Calculate cash flow and NPV. What is the sensitivity of NPV to changes in the sales figure. Explain what your answer tells you about a 500-unit decrease in projected sales.

b. What is the sensitivity of OCF to changes in the variable cost figure? Explain what your answer tells you about a $1 decrease in estimated variable costs.

2. Laverne Industries has a beta of 1.25. The company just paid a dividend of $.95 and the dividends are expected to grow at 4 percent. The expected return on the market is 11.5 percent and Treasury bills are yielding 3.8 percent. The most recent stock price is $81.

a. Calculate the cost of equity using the dividend growth model method

b. Calculate the cost of equity using the SML method.

c. Why do you think your estimates in (a) and (b) are so different?

3. A piece of newly purchased industrial equipment costs $1,500,000, has a salvage value of $100,000 and is classified as a five-year property under MACRS. Calculate the annual depreciation allowances and the end-of-year book values for this equipment.

4. A proposed new investment has projected sales of $825,000. Variable costs are 65 percent of sales and fixed costs are $187,150; depreciation $91,000. Prepare a pro forma income statement assuming a tax rate of 35 percent. What is projected net income? What is the operating cash flow?

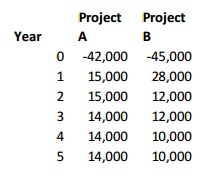

5. Below are the cash flows for two projects.

a. Compute the IRR for both projects.

b. Graph the NPV profiles for each project.

c. At what rate will the two projects have the same NPV?

d. Compute the profitability index for both projects. Use a 10% interest rate.

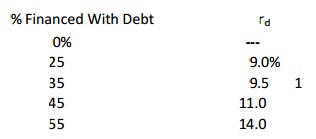

6. Below is information on proposed capital structures for The Palace

If the company were to recapitalize, debt would be issued, and the funds received would be used to repurchase stock. The Palace is in the 30 percent state-plus-federal corporate tax bracket, its beta is 1.1, the risk-free rate is 6 percent, and the market risk premium is 8 percent. Find the beta for the equity for each of the proposed capital structures.

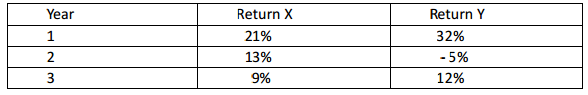

7. Using the following returns, calculate the average returns, the variance, standard deviations and coefficient of variation for X and Y.

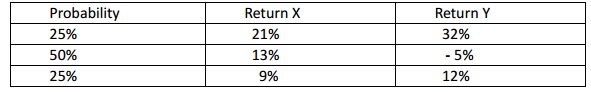

8. Using the following returns, calculate the expected returns, the variance, standard deviations and coefficient of variation for X and Y .