Reference no: EM131444621

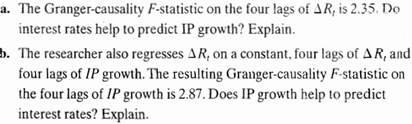

Question: The forecaster in given Exercise augments her AR(4) model for IP growth to include four lagged values of ?Rt where Rt is the interest rate on three-month U.S. Treasury bills (measured in percentage points at an annual rate).

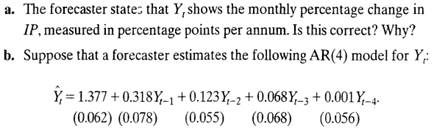

Exercise: The index of industrial production (IP) is a monthly time series that measures the quantity of industrial commodities produced in a given month. This problem uses data on this index for the United States. All regressions are estimated over the sample period 1960:1 to 2000:12 (that is, January 1960 through December 2000). Let Yi = 1200 x In(IPt/IPt-1).

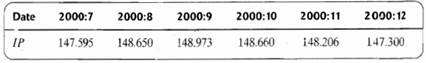

Use this AR(4) to forecast the value of Y, in January 2001 using the following values of IP for August 2000 through December 2000:

c. Worried about potential seasonal fluctuations in production, the fore-caster adds Xt-12 to the auto regression. The estimated coefficient on Xt-12 is -0.054 with a standard error of 0.053. Is this coefficient statistically significant?

d. Worried about a potential break, she computes a QLR test (with 15% trimming) on the constant and AR coefficients in the AR(4) model. The resulting QLR statistic was 3.45. Is there evidence of a break? Explain.

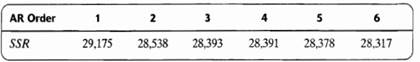

e. Worried that she might have included too few or too many lags in the model, the forecaster estimates AR(p) models for p = 1, , 6 over the same sample period. The sum of squared residuals from each of these estimated models is shown in the table. Use the BIC to estimate the number of lags that should be included in the auto regression. Do the results differ if you use the AIC?

|

Explanatory variable represents

: Suppose that in a regression analysis, the explanatory variable represents temperature, and the explanatory variable represents whether or not an individual is a male or female. Which statement is the most accurate given this information?

|

|

What is the companys cost of common equity

: Cost of Equity with and without Flotation Javits & Sons' common stock currently trades at $31.00 a share. It is expected to pay an annual dividend of $3.00 a share at the end of the year (D1 = $3.00), and the constant growth rate is 6% a year. What i..

|

|

What is percys cost of common equity

: Cost of Common Equity Percy Motors has a target capital structure of 40% debt and 60% common equity, with no preferred stock. The yield to maturity on the company's outstanding bonds is 8%, and its tax rate is 40%. Percy's CFO estimates that the comp..

|

|

Measures anova and a mixed-design anova

: What is the difference between a repeated measures ANOVA and a mixed-design ANOVA?

|

|

Calculate aic in given case

: The forecaster in given Exercise augments her AR(4) model for IP growth to include four lagged values of ?Rt where Rt is the interest rate on three-month U.S. Treasury bills (measured in percentage points at an annual rate).

|

|

External funds for the upcoming fiscal year

: Dahlia Colby, CFO of Charming Florist Ltd., has created the firm’s pro forma balance sheet for the next fiscal year. Sales are projected to grow by 12 percent to $350 million. Current assets, fixed assets, and short-term debt are 15 percent, 75 perce..

|

|

Determine the marginal pmf

: Write the correct integral to calculate and Determine the marginal PMF

|

|

Draw the payoff table and the opportunity loss tables

: a. Draw the Payoff Table and the Opportunity Loss tables. b. Find the optimal action according to Maximax, Maximin, and Maximum Likelihood. c. Write the expressions for EMV.

|

|

Calculate annual coupon interest payments

: Assume that today's date is February 15, 2015. Robin Hood Inc. bond is an annual-coupon bond. Par value of the bond is $1,000. Calculate annual coupon interest payments. Company-Robin Hood Price-128.499 Coupon Rate-6.534 Maturity date-2-15-2035 YTM- ..

|