Reference no: EM131317637

Strident Corporation is attempting to determine whether to lease or purchase a new telephone system. The firm is in the 40 percent tax bracket, and its after-tax cost of debt is currently 4.5 percent.

The terms of the lease and the purchase are as follows: Lease. Annual beginning-of-year lease payments of $22,000 are required over the five-year life of the lease. The lessor will pay all maintenance costs; the lessee will pay insurance and other costs. The lessee will exercise its option to purchase the asset for $30,000 paid along with the final lease payment.

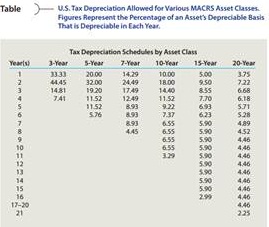

Purchase. The $100,000 cost of the telephone system can be financed entirely with a 7.5 percent loan requiring annual end-of-year payments of $24,716 for five years. The firm in this case will depreciate the equipment under MACRS using a five-year recovery period. (See Table 9.1 for applicable MACRS percentages.) The firm will pay $3,500 per year for a service contract that covers all maintenance costs; the firm will pay insurance and other costs. The firm plans to keep the equipment and use it beyond its five-year recovery period.

a. Calculate the after-tax cash outflows associated with each alternative.

b. Calculate the present value of each cash outflow stream using the after-tax cost of debt.

c. Which alternative, lease or purchase, would you recommend? Why?