Reference no: EM13918833

Cost System Choices, Budgeting, and Variance Analyses for Sacred Heart Hospital

Two Cost Systems

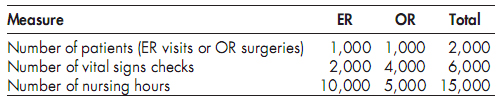

Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service lines - the Emergency Room (ER) and the Operating Room (OR). SHH's current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal $300,000. The table below shows expected patient volume for both lines.

1. Using the current cost system, calculate the hospital-wide rate based on number of patients. If required, round your answer to the nearest cent.

$ per patient

2. Calculate the amount of nursing costs that the current cost system assigns to the ER and to the OR.

|

The nursing cost, assigned to the ER

|

$

|

|

The nursing cost, assigned to the OR

|

$

|

3. Calculate the cost per OR nursing hour under the current cost system. If required, round your answer to the nearest cent.

$ per OR hour

After discussion with several experienced nurses, Jack Bauer (SHH's accountant) decided that assigning nursing costs to the two service lines based on the number of times that nurses must check patients' vital signs might more closely match the underlying use of costly hospital resources. Therefore, for comparative purposes, Jack decided to develop a second cost system on his computer that assigns total nursing costs to the ER and OR based on the number of times nurses check patients' vital signs. This system is referred to as the "vital-signs costing system". The earlier table also shows data for vital sign checks for lines.

4. Using the vital-signs costing system, calculate the hospital-wide rate based on the number of vital sign checks. If required, round your answer to the nearest cent.

$ per vital sign check

5. Calculate the amount of nursing costs that the vital-signs costing system assigns to the ER and to the OR.

|

The vital-signs cost, assigned to the ER

|

$

|

|

The vital-signs cost, assigned to the OR

|

$

|

6. Calculate the cost per OR nursing hour under the vital-signs costing system. If required, round your answer to the nearest cent.

$ per OR hour

Budgeting and Variance Analysis

In an effort to better plan for and control OR costs, SHH management asked Jack to calculate the flexible budget variance (i.e., flexible budget costs-actual costs) for OR nursing costs, including the price variance and efficiency variance that make up the flexible budget variance for OR nursing costs. Given that Jack is interested in comparing the reported costs of both systems, he decided to prepare the requested OR variance analysis for both the current cost system and the vital signs costing system. In addition, Jack chose to use each cost system's estimate of the cost per OR nursing hour as the standard cost per OR nursing hour. Jack collected the following additional information for use in preparing the flexible budget variance for both systems:

Actual number of surgeries performed = 950

Standard number of nursing hours allowed for each OR surgery = 5

Actual number of OR nursing hours used = 5,000

Actual OR nursing costs = $190,000

7. For the OR service line, use the information above and the cost per OR nursing hour under the current cost system to calculate the

$

flexible budget variance (Hint: Use your answer to Requirement 3 as the standard cost per OR nursing hour for the current cost system.)

price variance

$

efficiency variance

$

8. For the OR service line, use the information above and the cost per OR nursing hour under the current cost system to calculate the

$

flexible budget variance (Hint: Use your answer to Requirement 6 as the standard cost per OR nursing hour for the current cost system.)

price variance

$

efficiency variance

|

Planning the audit of a client financial statements

: (Assertions) In planning the audit of a client's financial statements, an auditor identified the following issues that need audit attention.

|

|

Develop the activity schedule for the project

: Develop the activity schedule for the project. Does it appear reasonable that construction of the athletic complex could begin one year after the decision to begin the project with the site survey and initial design plans?

|

|

Component in a healthy visual arts ecology

: ‘Sound business models are a necessary component in a healthy visual arts ecology and essential for most publicly funded organisations' (Royce, 2011, p. 3)

|

|

What must be the opportunity cost of capital

: A stock sells for $30. The next dividend will be $3 per share. If the return on equity ROE is a constant 15% and the company reinvests 40% of earnings in the firm, what must be the opportunity cost of capital?

|

|

Biggest nursing service lines

: Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service lines - the Emergency Room (ER) and the Operating Room (OR). SHH's current cost system assigns total nursing costs to the ER and OR b..

|

|

Long butterfly spread from options with strike prices

: A trader creates a long butterfly spread from options with strike prices of $60, $65, and $70 per share by trading a total of 60 option contracts (15 contracts at $60, 30 contracts at $65 and 15 contracts at $70). Each contract is written on 100 shar..

|

|

Complete a correlation on the data

: Complete a correlation on the data (StatTools: Summary Statistics/Correlation and Covariance/Correlation/Entries below the diagonal only).

|

|

Demonstrate an understanding of the materials

: Assume the role of Marketing Manager. Select a product (good or service) that is sold in the United States and has sales opportunities in a foreign market. Apply your critical thinking skills and the knowledge you have acquired throughout this cou..

|

|

The cost of raising capital through retained earnings

: The cost of raising capital through retained earnings is _____________ (a. less than, b. greater than) the cost of raising capital through issuing new common stock. The current risk-free rate of return is 3.8%. The market risk premium is 6.1%. D'Amic..

|