Reference no: EM131306715

Question 1. International Investment Decisions.

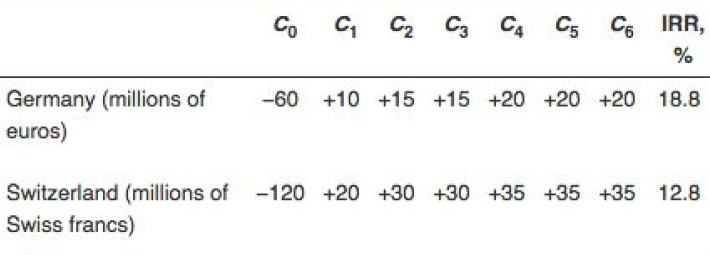

Carpet Baggers Inc. is proposing to construct a new bagging plant in a country in Europe. The two prime candidates are Germany and Switzerland. The forecast cash flows from the proposed plants are as follows:

The spot exchange rate for euros is USD1.3 = EUR1, while the rate for Swiss francs is CHF1.5 = USD1. The interest rate is 5% in the United States, 4% in Switzerland, and 6% in the euro countries. The financial manager has suggested that if the cash flows were stated in dollars, a return in excess of 10% would be acceptable.

a. What is the dollar NPV of the German project?

b. What is the dollar NPV of the Swiss project?

c. Should the company go ahead with the German project, the Swiss project, or neither?

Question 2. Exchange Rate Risk.

General Gadget Corp. (GGC) is a U.S.-based multinational firm that makes electrical coconut scrapers. These gadgets are made only in the United States using local inputs. The scrapers are sold mainly to Asian and West Indian countries where coconuts are grown.

a. If GGC sells scrapers in Trinidad, what is the currency risk faced by the firm?

b. In what currency should GGC borrow funds to pay for its investment in order to mitigate its foreign exchange exposure?

c. Suppose that GGC begins manufacturing its products in Trinidad using local (Trinidadian) inputs and labor. How does this affect its exchange rate risk?

|

Investigate the application of the chunking process

: The purpose of the study was to investigate the application of the chunking process to the design and delivery of workforce training. Students in a 1-hour course (N = 110) were measured on learner reaction, learning score achievement

|

|

Analyze what is the marginal rate of transformation impact

: What is the labor-intensive good? What is the Marginal Rate of Transformation impact? What is the labor-abundant country? What is the capital-abundant country?

|

|

What is the formula to calculate price elasticity of demand

: 201640-ECON202005 Microeconomic Principles - what is the formula to calculate price elasticity of demand - Find out Justin Bieber's concert ticket equilibrium quantity and price using the table. Draw the graph of supply and demand curve of JB and a..

|

|

What would be the quantities demanded and supplied

: Assume that government decides that landlords are charging exorbitant rental and hence passes a 'rent control' law in the United States of America that prevents rents from exceeding USD2000 per unit. What would be the quantities demanded and suppli..

|

|

Bf013 financial planning

: If GGC sells scrapers in Trinidad, what is the currency risk faced by the firm? b. In what currency should GGC borrow funds to pay for its investment in order to mitigate its foreign exchange exposure?

|

|

How would you address american critics of your practices

: Put yourself in the shoes of the local owner/manager of one of those factories in Indonesia, Bangladesh, etc. How would you address American critics of your practices?

|

|

Briefly describe what is meant by resawn glulam

: If the width of a lamination in a glulam beam is made up of more than one piece of wood, must the edge joint between the pieces be glued?

|

|

Would you fear retaliation if you reported unethical

: would you fear retaliation if you reported unethical activities to the whistleblowing program?" there would be a bit of a mixed reaction. Most people would be comfortable enough to voice grievances without any backlash. On the other hand, I think ..

|

|

Bf013 financial planning

: Assessment Brief A2 – Term 2,How much money did the company receive before paying its portion of the direct costs? How much did the existing shareholders receive from the sale of their shares?

|