Reference no: EM13378445

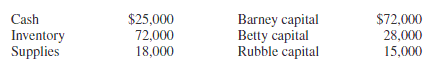

Barney, Betty, and Rubble are partners in a business that is in the process of liquidation. On January 1, 2011, the ledger accounts show the balances indicated:

�

The cash is distributed to partners on January 1, 2011. Inventory and supplies are sold for a lump-sum price of $81,000 on February 9, 2011, and on February 10, 2011, cash on hand is distributed to the partners in final liquidation of the business.

REQUIRED

1. Prepare the journal entry to distribute available cash on January 1, 2011. Include a safe payments schedule as proper explanation of who should receive cash.

2. Prepare journal entries necessary on February 9, 2011, to record the sale of assets and distribution of the gain or loss to the partners' capital accounts.

3. Prepare the journal entry to distribute cash on February 10, 2011, in final liquidation of thebusiness.