Reference no: EM13379691

Barmunda Pty Ltd harvests lavender and produces personal care products (for example, body wash, soap, hand cream, and powder) and home fragrances (for example, linen spray, and room freshener). The company also does embroidery on merchandise (for example, on sleepwear and towels) and sells these products.

You have been given the following information about Barmunda Pty Ltd:

• Sales for the financial year ending 30 June 2011 was:

• Barmunda Pty Ltd employs fifty-five (55) permanent staff, twenty (20) who have been employed by Barmunda Pty Ltd since it commence operations in1995 and fifteen (15) who have been employed by Barmunda Pty Ltd for more than ten years.

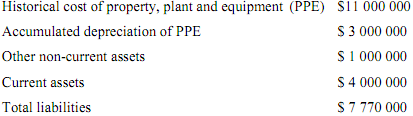

• Barmunda Pty Ltd had the following assets and liabilities as at 30 June 2011.

Required:

a) Advise the Management Committee of Barmunda Pty Ltd as to whether the company would be considered a reporting entity in accordance with SAC 1 ‘Definition of the Reporting Entity'. Justify your answer by discussing (a) the definition of a reporting entity and (b) discussing each of the three criteria above separately.

b) What will be the implications for Barmunda Pty Ltd if it is considered to be a reporting entity?