Reference no: EM132563320

Assignment Description:

Write a 1,000 word (maximum) essay for each question, on your thoughts and understanding of the role of managerial accounting decision-making tools and processes for two (2) of the three (3) scenarios provided below (1000 word for each scenario) Discuss how these tools may assist managers to navigate their short- and long-term operations as they respond globally to the COVID-19 pandemic (industry specific responses).

Part A.

Okanagan Orchard Products Limited is a manufacturer of jams and jellies. It distributes its products to food retailers across Canada. Okanagan's objective is to be the number one distributor of its product lines in Canada. Okanagan competes against a limited number of Canadian companies, but also must compete against several large American food manufacturers. It seeks to increase market share through the delivery of quality products. It believes it can achieve its objectives through high quality control in its manufacturing processes, improved efficiency (particularly relating to yields), and innovation of its products.

Okanagan has had problems with employee turnover, both in production and administration. It pays competitive wages but still has struggled managing employee turnover. Employee surveys have determined that employees do not believe the company provides adequate training or support and that employees are unaware of opportunities for advancement.

Required

1. Create a balance scorecard for Okanagan Orchard Products Limited using the traditional four perspectives.

2. What types of sustainability measures would you recommend for Okanagan?

3. What specific measures could Okanagan take to address its employee turnover issues?

Part B.

Sunset Heights Animal Rescue and Protection Society (SHARP) is a non-profit organization dedicated to the rescue and protection of domestic animals. It operates several animal shelters in the Sunset Heights area including animal adoption services, rescues injured or abused domestic animals, and educates volunteers, pet owners, and potential pet owners on animal guardianship. As with all charitable organizations, it is facing increased competition in raising funds and recruiting volunteers. It is also experiencing greater demands for accountability from its donors. Recently it was unable to respond to its Board of Directors on the costs of running each of its programs and its allocation of funds received into various programs. Although SHARP is expected it to operate with a balanced budget, it reported an operating deficit last year.

Required

1. Create a balance scorecard for SHARP. In your answer, consider the various programs/services Sharpe provides.

2. What are the corporate governance issues raised, and how might they be addressed?

3. What are three (3) recommendations you would have? Explain your answers.

Part C.

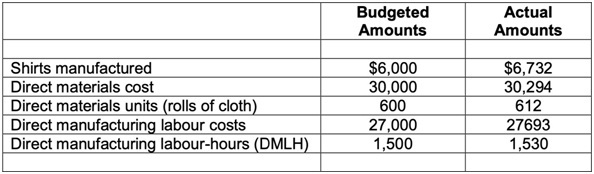

New Fashions Ltd manufactures shirts for retail chains. Andy Jorgenson, the controller, is becoming increasingly disenchanted with New Fashions' standard costing system. The budgeted and actual amounts for direct materials and direct manufacturing labour for June 2019 were as follows:

There were no beginning or ending inventory of materials.

Standard costs are based on a study of the operations conducted by an independent consultant six months earlier. Jorgenson observes that, since that study, he has rarely seen an unfavourable variance of any magnitude. He notes that even at their current output levels, the workers seem to have a lot of time for sitting around and gossiping. Jorgenson is concerned though that the production manager, Charlie Fenton, is aware of this but does not want to tighten up the standards because the standards make his performance look good.

Required

1. Compute the price and efficiency variance of New Fashions for direct materials and direct manufacturing labour in June 2019

2. Describe the types of actions the employees at New Fashions may have taken to reduce the accuracy of the standards set by the independent consultant. Why would employees take those actions? Is this behaviour ethical?

3. If Jorgensen does not do anything about the standard costs, will his behaviour violate any of the ethical conduct characteristics described in the course (see chapter 1)?

4. What actions should Jorgensen take?

5. Jorgensen can obtain benchmarking information about the estimated costs of New Fashions' major competitors from Benchmarking Clearing House (BCH). Discuss the pros and cons of using the BCH information to compute the variances in requirement one above.

For your selected scenario, you may also want to reflect on...

1. The importance that managerial accounting decision-making tools may have to foster and sustain profitable operations in the short- and long-term,

2. the challenges your selected companies may presently, and continue to, face during this uncertain global health care call to action and how the managerial accounting decision-making tools can assist managers to either recalibrate or create new operational strategies, and

3. what you have learned about what it means to be an impactful, innovative, and/or effective leader in terms of navigating an organization through uncharted practice and operations.

Formatting and Submission Instructions

• Support any of your findings and/or recommendations with appropriate literature and cite authors or the source. Footnotes can also be used.

• Use in-text APA citations as appropriate and include a References List.

• Upload your completed Word file to the Moodle Final Assessment Submission box located in Week 11.

• Maximum length is 1,000 words (not including references) for each question