Reference no: EM131461

You are an Audit Senior of Kamal Chartered Accountants (KCA) a boutique 3 partner firm with 20 staff. It is 16 July 2013 and your firm has engaged in the tender to become the external auditor of 4X Heavy Ltd for the 30 June 2013 audit. 4X Heavy Ltd is a company that runs multiple Fitness Centres throughout NSW, Australia and has been in operation since 1991.

Pammy Ngo, one of KCA's Audit Managers was formerly a Fitness Instructor at 4X Heavy Ltd and coincidently joined KCA on 16 February 2013 prior to tender. 4X Heavy Ltd are initiating an aggressive expansion in 2013, with management having plans to list the company on the ASX within the next 5 years.

The 2013 financial year saw 4X Heavy Ltd encounter strong competition from new fitness gyms entering the market as with facing the new popular fitness regime "Ya Ya Yoga", which is a regime exclusive to Ya Ya Fitness Gyms. Other Notable operational challenges for 4X Heavy Ltd faced in 2012/2013 were but not limited to:

- 4X Heavy Ltd borrowed substantially from KNVB Bank in order to purchase the equipment required for its gyms. The finance involved a mixture of both leases over the equipment where KNVB continued to hold legal title as well as some equipment on

chattel mortgages where 4X Heavy holds legal title. Overriding these finance arrangements is a covenant from KNVB requiring 4X Heavy Ltd to maintain a debt to equity ratio of no more than 2.5:1 at each reporting date.

- In order to rapidly grow its membership base and revenue stream, 4X Heavy has built a substantial network of fitness instructors to recruit new members to the gym. These fitness instructors are remunerated on a commission basis at 15% of the value of the membership subscription signed up from each new customer. Each month the fitness instructors are required to provide the finance department of 4X Heavy with a claim sheet showing details of each new member to support the commission claimed. The finance department checks this against membership contracts previously provided by the fitness instructor when the new customer signed up prior to payment.

- Management of 4X Heavy perceived that the number of finance staff at 4X Heavy was an excess to the requirements of the business. As a consequence an accounts payable clerk and financial accountant were made redundant from the business during the year. This resulted in the business only having one accounts payable clerk to maintain purchases and monitor payables whilst all review of monthly reconciliations were left to the financial controller. A number of 4X Heavy suppliers have complained about the slowness at which 4X Heavy has been paying its invoices.

- An internal audit review of operations during the year found that the volume of people entering and working out at the gym has increased but appears to be inconsistent with membership numbers and revenues generated. A further analysis has shown that repairs and maintenance expense as a percentage of sales has increased in 2012/13 compared with the previous financial year.

- Management of 4X Heavy have started to notice that an increasing trend of customers have been leaving the gym and joining competitors who have been offering the latest state of the art gym equipment as shown on late night infomercials featuring Chucky Norris. 4X Heavy is finding it difficult to rearrange its finance with KNVB in order to upgrade their existing equipment to react to this trend.

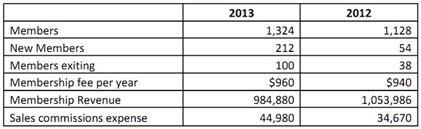

Your recent review of management financial data for 2012/13 has shown the following key statistics:

FINANCIAL DATA:

Question PART A: Since 4X Heavy Ltd is a new client of KCA outline the steps that you would initially undertake as part of taking on this client

Question PART B: Based on the facts specific to 4X Heavy Ltd:

(a) Identify the audit inherent risk and rate the risk as low, medium or high.

(b) Identify the audits control risk

(c) Evaluate control and inherent risk

(d) Determine overall audit strategy

Question PART C:

a) Identify 2 key account balances that are at highest risk of misstatement

b) Explain why these are the highest risk

c) Design 4 substantive audit tests to carry out the work performed on each of the identified 2 key account balances.

d) For each of the 4 substantive audit test designed identify the key assertion it addresses.

Question PART D:

(a) Based on the above make 4 recommendations to management on completion of audit.