Reference no: EM132476969

Assignment - Financial Accounting Questions

Q1. On June 30, 2015, Martin Co. has assets of $22,000 and owners' equity of $5,000. What is the total of its liabilities on that date?

$17,000

$22,000

$27,000

Cannot be determined without its common stock balance on June 30, 2015

Q2. Tripod Inc. began the month with accounts receivable of $25,000. During the month, it collected $12,000 from customers and sold $5,000 of merchandise on credit. What is its accounts receivable balance at the end of the month?

$32,000

$18,000

$42,000

Cannot be calculated

Q3. Barnaby & Sons receives a large shipment of goods from its supplier. It pays $42,000 at the time of delivery and promises to pay the remaining $58,000 within the next two months. What is the appropriate journal entry for this transaction?

Debit cash $42,000; debit inventory $16,000; credit accounts payable $58,000

Debit inventory $100,000; credit cash $42,000; credit accounts payable $58,000

Debit accounts payable $58,000; credit cash $42,000; credit inventory $16,000

Debit accounts payable $58,000; debit cash $42,000; credit inventory $100,000

Q4. On June 1, 2015, Planet Music has accounts payable of $12,000. During the month, debits of $3,000 and credits of $11,000 were made to the account. At the end of June 2015, what was the accounts payable balance?

A credit balance of $20,000

A debit balance of $20,000

A debit balance of $4,000

A credit balance of $4,000

Q5. Financial accounting is an information system that

assigns a share price to every company

tracks and records an organization's business transactions

provides information about the company's executives.

predicts the financial survival of a company.

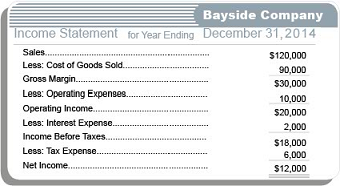

Q6. Paxson's December 31, 2013, prepaid expense balance was $9,000. During 2014, $7,000 of the prepaid expense asset expired. How much cash did Paxson pay toward prepaid expenses in 2014?

$4,000

$8,000

$10,000

Cannot be estimated

Q7. Ignoring any tax implications what is the effect on a company's balance sheet when depreciation expense is recognized?

Total assets and shareholder's equity will decrease by the same amount.

Shareholder's equity is unaffected.

Total liabilities increase and shareholder's equity decreases by the same amount.

This transaction affects only the income statement.

Q8. Paxson began 2014 with the following non-current asset balances: Plant and equipment (net) $29,500; Patent (net) $14,000. No long-term assets were purchased or sold during the year. How much amortization and depreciation expense did Paxson record during 2014?

$1,500

$2,000

$3,500

Cannot be estimated

Q9. Pots and Things, the cookware retailer, sells a crock pot to a customer for which Pots and Things had paid $90. Which one of the following statements describes the most appropriate accounting for the transaction?

Debit cost of goods sold expense $90; credit cash $90

Debit inventory $90; credit cost of goods sold expense $90

Debit cost of goods sold expense $90; credit inventory $90

Debit inventory $90; credit accounts payable $90

Q10. Net Income = Revenues minus ___________________

Cash

Sales

Debt

Expenses

Q11. Goodwill should

never be recorded as an asset

be amortized over a maximum of twenty years

be amortized over a maximum of thirty years

be tested for impairment and not amortized

Q12. Which of the following statements is correct?

Both interest incurred and dividends declared reduce net income.

Dividends declared, but not interest incurred, reduce net income.

Interest incurred, but not dividends declared, reduces net income.

Neither interest incurred nor dividends declared reduce net income

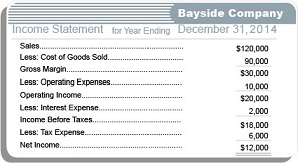

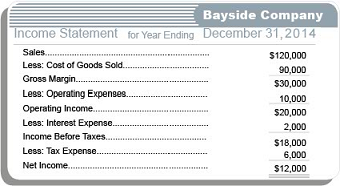

Q13. Bayside began 2014 with an interest payable account balance of $13,000. On December 31, 2014, its interest payable account balance is $11,000. How much interest was paid during 2014?

$4,000

$5,000

$2,000

$3,000

Q14. Which of the following would qualify as a capital lease?

The lease term is 60% of the asset's estimated useful life.

The present value of the lease payments equals 55% of the fair market value of the leased asset.

The lease term is 65% of the asset's estimated useful life.

The lease term is 90% of the asset's estimated useful life.

Q15. Choose the word that best completes the following sentence: In the statement of cash flows, an organization's cash flows are classified as those arising from operating activities, ________ activities and financing activities.

trading

planning

selling

investing

Q16. Which of the following statements is wrong?

For accounting purposes,

internally generated goodwill is recorded as an asset.

goodwill is recorded as an asset when a company purchases another company.

goodwill is tested for impairment regularly.

goodwill impairments reduce net income

Q17. Which of the following statements is correct?

Unrealized gains and losses on trading securities are recognized in income

Unrealized gains and losses on held-to-maturity securities are recognized in income.

Unrealized gains and losses on available-for-sale securities are recognized in income.

Unrealized gains and losses on held-to-maturity securities are recognized in other comprehensive income.

Q18. Pots and Things, a cookware retailer, sells a coffee machine to a customer for $150. The customer pays $100 in cash and puts the rest on her store credit account. Which one of the following statements describes the most appropriate accounting for the transaction?

Debit cash $100; debit accounts receivable $50; credit cost of good sold $150

Debit cash $100; debit accounts receivable $50; credit revenues $150

Debit revenues $150; credit cash $100; credit accounts receivable $50

Debit cash $100; debit accounts receivable $50; credit inventory $150

Q19. On January 1, 2012, Suntory Company purchased a stamping machine for $100,000. It had an estimated useful life of five years and a disposal value of $10,000. The machine is depreciated on a straight-line basis and on December 31, 2016, it is sold for $20,000.

The fact that the machine is recorded as an asset on January 1, 2012, and depreciated - or recorded as an expense - over time, is a reflection of the _______ concept.

matching

consistency

conservatism

materiality

Q20. aylor Company had a salaries payable balance of $420,000 on December 31, 2013. During 2014, it paid $550,000 in cash as salaries, and recorded a salary expense of $500,000. What is its December 31, 2014, salaries payable balance?

$470,000

$370,000

$920,000

Cannot be determined from the information provided

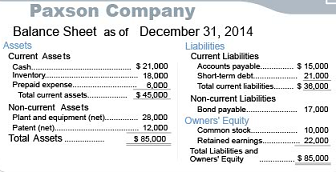

Q21. This question refers to Bayside Company's 2014 Income Statement.

Bayside began 2014 with an inventory T-account debit balance of $155,000. Inventory purchases during the year amounted to $75,000. There were no inventory-related write-downs or losses.What is its December 31, 2014, inventory account balance?

$170,000

$140,000

$10,000

Cannot be estimated

Q22. Bayside began 2014 with a retained earnings account balance of $132,000. During 2014, it did not declare or pay any dividends.What is its December 31, 2014, retained earnings account balance?

$132,000

$120,000

$144,000

Cannot be calculated

Q23. The beta company began operations on January 1, 2016, and uses the LIFO method in costing its raw material inventory. What would the net income have been if the company had consistently followed FIFO instead of LIFO since January 1, 2016?

|

|

12/31/2016

|

12/31/2017

|

|

Final Inventory

|

|

|

|

Under FIFO

|

$200,000

|

$220,000

|

|

Under LIFO

|

$250,000

|

$280,000

|

|

|

For 2016

|

For 2017

|

|

|

|

|

|

Pretax Income under FIFO

|

$130,000

|

$160,000

|

$100,000

$160,000

$170,000

$200,000

Q24. Sardi Company estimates its 2015 tax expense to be $30,000. It makes a cash payment of $20,000 to the tax authorities on December 31, 2015. Choose the statement that best describes the recording of this transaction.

Debit tax expense $30,000; credit cash $10,000; credit taxes payable $20,000

Debit tax expense $30,000; credit cash $20,000; credit taxes payable $10,000

Debit tax expense $20,000; credit cash $20,000

Debit tax expense $30,000; credit cash $20,000; credit accounts payable $10,000

Q25. EFG signed a 10-year operating lease agreement whereby ABC rentals will provide a machine which costs ABC $60,000. The lease payments are $5,000 payable at the end of each year. The machine will revert to ABC at the end of ten years. The machine has a useful life of 20 years. At the inception of the lease EFG should

record rental expense of $5,000.

record rental expense of $10,000.

make no journal entry.

record the lease asset and a corresponding liability at its current market value.

Q26. Which of the following is one of several conditions that must be met for an item to be recorded as an asset?

At least 50% of the item's purchase price has to have been paid to the seller in cash.

It must have a measurable resale value.

The item can be used as collateral in getting a loan from a bank.

The item must have been acquired at a measurable cost.

Q27. In periods with decreasing prices and increasing quantities of inventories, which of the following relationships among inventory valuation methods is generally correct?

LIFO has a higher inventory balance and a higher net income than FIFO.

FIFO has a higher inventory balance and a lower net income than LIFO.

LIFO has a lower inventory balance and a lower net income than FIFO.

FIFO has a higher inventory balance and a higher net income than LIFO.

Q28. On October 10, Jayson Company receives an order for a $700 TV which it will deliver to the customer on October 17. The customer pays the full amount in cash at the time of the order. Besides recording the receipt of $700 cash, what else should Jayson record on October 10?

Record $700 revenue

Record some of the $700 as revenue now and the rest on delivery of the TV

Record a $700 liability

Make no record at this time; record revenue and receipt of cash on delivery of TV

Q29. Which one of the following is the best definition of owners' equity?

The market value of the outstanding common stock

The amount that owners would receive if they sold the entity

The cash balance less outstanding debts

The difference between assets and liabilities

Q30. On January 1, 2012, Suntory Company purchased a stamping machine for $100,000. It had an estimated useful life of five years and a disposal value of $10,000. The machine is depreciated on a straight-line basis and on December 31, 2016, it is sold for $20,000. In 2014, how much annual depreciation expense would Suntory record on the stamping machine?

$20,000

$10,000

$18,000

Cannot be estimated with the data provided

Q31. On June 30, 2014, Zono Electronics, Inc. made a payment of $3,500 to State Bank. Of that payment, $2,500 was interest and the rest was a payment towards the outstanding long-term loan principal. Choose the statement that best describes the recording of this financial transaction.

Debit long-term loan $2,500; debit interest expense $1,000; credit cash $3,500

Debit cash $3,500; credit long-term loan $2,500; credit interest expense $1,000

Debit long-term loan $3,500; credit cash $3,500

Debit interest expense $2,500; debit long-term loan $1,000; credit cash $3,500

Q32. Spinner Toy Company's inventory account increased from $15,000 on December 31, 2013, to $20,000 on December 31, 2014. Pick one statement from the set below that would reconcile with this increase in Spinner's inventory account.

Spinner's 2014 cost of goods sold was $42,000; its 2014 inventory purchases were $37,000

Spinner's 2014 cost of goods sold was $20,000; its 2014 inventory purchases were $15,000.

Spinner's 2014 cost of goods sold was $42,000; its 2014 inventory purchases were $47,000.

Spinner's 2014 cost of goods sold was $15,000; its 2014 inventory purchases were $10,000.

Q33. Merrit CO. purchased a truck costing $100,000 and paid shipping costs of $10,000. Merrit spent an additional $5,000 on preparing the truck for use. What amount should Merrit record as the cost of the truck?

$100,000

$115,000

$110,000

$105,000

Q34. Select one answer that best fills the blank: Assets minus liabilities equals __________ .

income

cash

owners' equity

common stock

Q35. DFG expenses stock options as required by GAAP. On January 1, 2017, DFG granted 100 executives 200 options each. Each option entitled the option holder to purchase one share of DFG common stock at $8 per share. The options will vest on January 1, 2019.

On the grant date, January 1, 2017, the stock was quoted on the stock exchange at $10 per share. The fair value of the options on grant date was estimated to be $3 per option. What is the amount of compensation expense DFG should recognize with respect to the options during 2017, 2018, and 2019, respectively?

$10,000, $10,000 and $10,000

$20,000, $20,000 and $20,000

$0, $0 and $60,000

$30,000, $0 and $0

Q36. In the statement of cash flows, the purchase of a building is classified as a(n) _______ activity.

financing

investing

operating

trading

Q37. On January 1, 2012, Suntory Company purchased a stamping machine for $100,000. It had an estimated useful life of five years and a disposal value of $10,000. The machine is depreciated on a straight-line basis and on December 31, 2016, it is sold for $20,000. For the 2016 annual accounting period, Suntory will

record a loss of $10,000 on the stamping machine.

reduce the depreciation recorded on the stamping machine by $20,000.

reduce the depreciation recorded on the stamping machine by $10,000.

record a gain of $10,000 on the stamping machine.

Q38. In 2014, Paxson incurred a net loss of $2,500. No dividends were declared or paid during 2014. What was Paxson's retained earnings balance one year earlier on December 31, 2013?

$24,500

$2,500

$19,500

Cannot be estimated

Q39. Which one of the following conditions is not a requirement for an item to be recorded as a liability on a company's balance sheet?

It involves a probable future sacrifice of economic resources by the company.

It reduces the market value of the company.

It involves a probable future sacrifice to another entity.

It is a present obligation, arising from a past transaction or event.

Q40. Which of the following financial statements describes an entity's financial position at a point in time?

A direct method statement of cash flows

An income statement

A balance sheet

An indirect method statement of cash flows

Q41. Morgan & Sons needs to record annual depreciation of $12,000 on its plant assets. Which statement best describes the appropriate way to record the depreciation?

Debit accumulated depreciation $12,000; credit depreciation expense $12,000

Debit depreciation expense $6,000; credit accumulated depreciation $6,000

Debit depreciation expense $12,000; credit accumulated depreciation $12,000

Debit accumulated depreciation $12,000; credit plant assets $12,000

Q42. Plaza Realty's statement of cash flows shows that during 2014, it had a net investing cash inflow of $20,000; a net financing outflow of $10,000 and a net increase in the cash balance of $30,000. What is its cash flow from operations?

A net inflow of $0

A net inflow of $20,000

A net inflow of $40,000

A net outflow of $30,000

Q43. The first line item in Torrington Company's statement of cash flows is its positive net income for the period. From this we can say for sure that

this is Torrington's direct method statement of cash flows.

Torrington's cash flow from operations is positive

this is Torrington's indirect method statement of cash flows.

Torrington's operating cash flows exceeded its net income for the period.

Q44. Jeff Brown, owner of Shoe Central, a small shoe store, buys cleaning supplies for his store once every six months. The fact that his accountant writes off, or records as expenses, the full cost of the cleaning supplies when they are purchased, rather than each monthly accounting period as they are used, is an application of the _______ concept.

matching

money measurement

materiality

historical cost

Q45. On April 30, Jemison Engineering receives a special order for a swing set to be delivered to the customer in a month's time. Jemison purchases a number of items specifically for the construction of the swing set: lumber, chains, railings and paint. According to the matching concept, when will Jemison Engineering record the cost of those special items as a cost of goods sold expense?

As each item is purchased

As each item is used in the production of the swing set

When the revenue for the swing set is recorded

As soon as the special order is received

Q46. Oliver Enterprises buys a new stamping machine for $10,000 at an auction held by a company in bankruptcy proceedings. The machine is a very good deal; Oliver would have paid about $12,000 to buy it in the open market. Which of the following statements best describes the application of the historical cost concept?

Oliver should record the new machine asset for $12,000, the most relevant amount.

Oliver should record the new machine asset for $10,000, the most reliable amount.

Oliver should record the machine at the average appraised value from at least three appraisers.

Oliver should record the new machine asset for $10,000 and immediately record a gain of $2,000.

Q47. Since auditors have to attest to the validity of a company's financial statements, what among the following is the most important characteristic for an auditor to have?

Huge personal wealth

Knowing a good lawyer

Independence

Personal relationships with the company's managers

Q48. On January 1, 2012, Suntory Company purchased a stamping machine for $100,000. It had an estimated useful life of five years and a disposal value of $10,000. The machine is depreciated on a straight-line basis and on December 31, 2016, it is sold for $20,000. The $20,000 cash inflow from the sale of the stamping machine will

be included in the operating activities section of Suntory's 2016 statement of cash flows.

be included in the investing activities section of Suntory's 2016 statement of cash flows.

be included in the financing activities section of Suntory's 2016 statement of cash flows.

not be included in Suntory's 2016 statement of cash flows.

Q49. Dow Corp. bought a truck for $80,000 on January 1, 2018. They installed a rear hydraulic lift for $10,000 and paid sales tax of $4,000. In addition, Dow Corp. paid $3,000 for a one-year insurance policy. They estimate the useful life of the truck to be 10 years and its residual value $12,000.

If Dow uses the straight line method of depreciation, what is the depreciation expense for 2019 and the book value at the end of 2019?

$9,000 and $70,000

$8,200 and $77,600

$8,500 and $78,000

$10,200 and $80,000

Q50. The Herb Company had the following balances in their stockholder's equity accounts as of December 31, 2018:

Paid in capital: $100,000

Retained earnings: $50,000

During the year ended December 31, 2018, the Herb Company generated $60,000 in net income and declared and paid $20,000 in dividends. The ending balance in the retained earnings account at December 31, 2017, was _______.

$50,000

$60,000

$10,000

$20,000

Q51. Which one of the following statements describes the rules about posting transactions into T-accounts in the ledger?

For assets, debits are entered on the left; for liabilities, credits are entered on the left

For assets, credits are entered on the left; for liabilities, debits are entered on the left

Debits on the left; credits on the right

Credits on the left; debits on the right

Q52. Devin Co. sells household appliance service contracts for cash. The service contracts are one-year, two-year or three-year periods. Cash receipts from contracts are credited to unearned service revenues. This account had a balance of $2,000,000 at December 31, 2018, before the year-end adjustment.

What amount should be reported as Unearned Service Revenues in Devin's December 31, 2018, balance sheet?

Service contracts still outstanding at December 31, 2018 expire as follows:

|

During 2019

|

$500,00

|

|

During 2019

|

$1,200,00

|

|

During 2019

|

$200,00

|

$1,900,000

$2,000,000

$1,800,000

$1,600,000

Q53. The next four questions refer to the December 31, 2014, Balance Sheet of Paxson Company.

Paxson began 2014 with an inventory T-account debit balance of $22,000. In 2014, its inventory purchases amounted to $42,000, and it had no inventory-related write-downs or losses. What amount did Paxson record as cost of goods sold expense in 2014?

$46,000

$38,000

$4,000

Cannot be estimated from the data provided

Q54. Which of the following is/are necessary criteria for recognizing revenue from a sale?

The company is reasonably assured of collecting the receivable and titles and risks of ownership have been exchanged.

The customer has in turn sold the product to its own customer.

The company is reasonably assured of collecting the receivable.

Titles and risks of ownership have been exchanged.

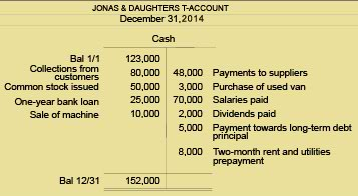

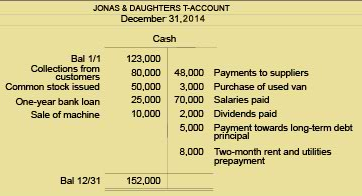

Q55. What is Jonas & Daughters' 2014 cash flow from investing activities?

A net inflow of $10,000

A net outflow of $7,000

A net outflow of $1,000

A net inflow of $7,000

Q56. On January 1, 2012, Suntory Company purchased a stamping machine for $100,000. It had an estimated useful life of five years and a disposal value of $10,000. The machine is depreciated on a straight-line basis and on December 31, 2016, it is sold for $20,000. On Suntory's December 31, 2014, balance sheet accounts, the stamping machine would have a net book value of _______.

$46,000

$36,000

$54,000

$64,000

Q57. Tournas Sports receives a special order for 100 team jerseys. The customer pays the full amount, $2,000, at the time of the order. The jerseys will be delivered in two weeks. Choose the statement that best reflects the application of the revenue recognition concept at the time of the order.

Revenue of $2,000 has been earned and realized.

Revenue of $2,000 has been earned but not realized.

Revenue of $2,000 has been realized but it has not been earned.

Revenue of $2,000 has neither been earned nor realized.

Q58. Temtron Inc. pays $1,000 in cash as interest to its lenders during 2014. According to U.S. GAAP, in which section of the statement of cash flows would this payment be included?

The operating section

The financing section

The investing section

None of the above

Q59. Get Inc. reported net income of $50,000 for 2017. However, the company's income tax return excluded a revenue item of $6,000 (reported on the income statement) because under the tax laws the $6,000 would not be reported for tax purposes until 2018. Assuming a 30% income tax rate, this situation would cause a 2017 deferred tax amount of

$1,800 liability.

$1,800 asset.

$6,000 asset.

$6,000 liability.

Q60. What is Jonas & Daughters' 2014 cash flow from financing activities?

A net inflow of $75,000

A net outflow of $68,000

A net inflow of $68,000

A net inflow of $50,000

Q61. Bayside began 2014 with a taxes payable account balance of $3,000. During the year, it made a cash payment of $2,000 to the tax authorities. On December 31, 2014, what is its taxes payable account balance?

$7,000

$5,000

$8,000

Cannot be calculated

Q62. The following question is based on Jonas & Daughters' cash T-account at the close of business on December 31, 2014

What is Jonas & Daughters' 2014 cash flow from operations?

A net inflow of $38,000

A net outflow of $38,000

A net inflow of $46,000

A net outflow of $46,000

Q63. Dow Corp. bought a truck for $80,000 on January 1, 2018. They installed a rear hydraulic lift for $10,000 and paid sales tax of $4,000. In addition, Dow Corp. paid $3,000 for a one-year insurance policy. They estimate the useful life of the truck to be 10 years and its residual value $12,000.

If Dow uses the double declining method of depreciation, what is the depreciation expense for 2019?

$18,800

$19,400

$15,040

$17,711

Q64. A company raised $50,000 in cash by taking a one-year loan from a bank. Which of the following best describes the journal entry to record this transaction?

Debit short-term debt $25,000; credit cash $25,000

Debit short-term debt $50,000; credit cash $50,000

Debit cash $50,000; credit long-term debt $50,000

Debit cash $50,000; credit short-term debt $50,000

Q65. Which one of the following is classified in the statement of cash flows as an operating activity?

Getting a loan from a bank

Buying a computer system that will last 5 years

Selling merchandise

None of the above

Q66. Jeff Brown is the sole owner of Shoe Central, a small shoe shop. One day, he buys a used car for his personal use, and pays $2,000 from his checking account. The fact that this transaction has no effect on Shoe Central's financial accounts is an application of the _______ concept.

materiality

money measurement

going concern

entity

Q67. In financial accounting, what does relevance refer to?

The verifiability of the reported information

The precision of the reported information

The objectivity of the reported information

The usefulness of the reported information for economic decisions

Q68. On July 31, 2018, Coal Inc. exchanged 5,000 shares of Steel corporation $40 par value common stock for a trademark owned by Vega Co. The Steel stock was acquired in 2013 at a cost of $160,000. At the exchange date, Steel common stock had a fair value of $43 per share and the trademark had a net carrying value of $170,000 on Vega's books. Coal should record the trademark at _______.

$200,000

$170,000

$160,000

$215,000