Reference no: EM13519505

Question : The Luna Mining Company (LMC) was incorporated in 1973 to develop mineral deposits in Canada's north. In 2004, the company discovered a promising quartz ore body in the Northwest Territories just outside the town of Carlsbad. Preliminary sampling indicated high concentrations of several valuable minerals including gold, silver and platinum. In 2005, a mineshaft was constructed along with a processing plant and administrative offices. The mine's development lead to the economic revival of the town of Carlsbad. During 2005, twenty new

homes, a sixty-unit trailer park and several new businesses were established.

Mining and processing operations began in January 2006 and have continued without interruption since that date. During 2013, the company removed 1.2 million tons of ore from the mine; this level of production is expected to continue for the next twenty-five years. Overall, the

company hopes to earn a 15 per cent pretax profit on sales although this has not been met in recent years. The cost of transporting personnel and materials between Carlsbad and the closest railway link during the summer months has become prohibitive. Furthermore, the northern isolation of Carlsbad has resulted in a high turnover of production and administrative personnel.

The process of extracting valuable minerals begins with the removal of ore from the ground by drilling and blasting the underground ore body. The raw unrefined ore must then be transported to the surface and crushed so that the particles are no greater than 1/60 of a centimeter in diameter. The crushed ore is then ready to enter the refining process. The total cost of mining and crushing the ore amounts to $30.65 per ton.

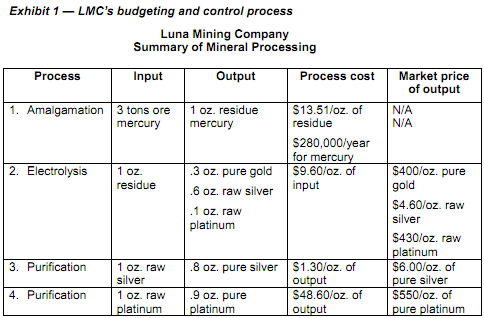

In order to extract the usable minerals, the crushed ore is passed through three distinct processes: amalgamation, electrolysis and purification (see Exhibit 1). In the first stage, called amalgamation, mercury is added to the unrefined ore. The mercury combines with the valuable minerals forming a compound that is drawn off. This compound is then heated causing the mercury to vaporize, leaving a residue that is 30 per cent gold, 60 per cent silver, and 10 per cent platinum. One ounce of residue is obtained for every 3 tons of ore placed in the process. The vaporized mercury is condensed and reused the next day. The total cost of the amalgamation process is $13.51 per ounce of residue recovered. Each year the company must invest an additional $280,000 to replace mercury lost during the recovery process.

The second process is called electrolysis. In this process, the residue from the amalgamation process is cast into thick slabs that are hung in large vats of acid. When an electric current is passed through the vat, pure gold is transferred to separate plates. When the gold plates and acid are removed from the vat, silver is recovered from the bottom of the vat. When the acid is filtered for reuse the next day, platinum is removed. The total cost of the electrolysis process is $9.60 per ounce of residue placed in the vat.

At this point, the gold plates are 99.9 per cent pure and can be sold on world markets. The current market price for gold is $400.001 per ounce but mine officials are aware that future prices may rise or fall from this level depending on the state of the world economy. During the

past three months, the price has ranged from $350 to $420 per ounce.

The silver can be sold after electrolysis for $4.60 per ounce or it can be further purified. Purification costs are $1.30 per ounce of pure silver, which can be sold for $6.00 per ounce (both the $6.00 and $4.60 prices have remained relatively stable during the past year and

management expects no significant changes during the next year). This purification process reduces the volume of the silver product by 20 per cent.

The platinum can be sold after electrolysis for $430.00 per ounce or further purified and sold for $550.00 per ounce. Purification results in a 10 per cent reduction in the volume of platinum. The total cost of purification is $48.60 per ounce of pure platinum.

During the winter, food and supplies are brought to the mine and the town of Carlsbad from the town of Fargo on a winter road built over the frozen tundra and lakes. Fargo is LMC's closest link to a railway line. Once the supply trucks are emptied, processed minerals are loaded for shipment to outside markets. The total cost of winter road transportation was $3 million in 2013. This cost was split equally between LMC and residents of Carlsbad. During the spring, summer and fall periods, all shipments between Fargo and the mine site have to be made by floatplane and helicopter. LMC spent a total of $5.5 million on these flights during 2013. No figures were available on summer transportation expenditures for local businesses and residents.

The high cost of transporting supplies and personnel to the mine site and getting processed minerals to the outside market is of great concern to the management of LMC. They are now considering the option of building a railroad from Carlsbad to Fargo. Preliminary studies have indicated that construction of the railroad would cost $75 million and that a train (engine, box cars, caboose and a passenger car) would cost an additional $15 million. With the railroad, LMC would be able to charge the residents of Carlsbad for freight and passenger fares for trips to and from Fargo. It is estimated that the revenue collected from freight and passenger fares would amount to $570,000 per year. The operating and maintenance costs (not including interest and depreciation) for the railroad would be $240,000 and $140,000 per year respectively. LMC expects the railroad and train to last for 25 years with no salvage value at the end of that time. Money to finance the purchase of the train and construction of the railroad would be borrowed at a rate of 10 per cent per annum. The CCA rate for the railroad and train are set at 4 per cent and 10 per cent respectively and LMC would depreciate the fixed assets for financial reporting purposes using the straight-line method. Management believes that the railroad would eliminate the need for summer airfreight and winter roads between Carlsbad and Fargo. Also, administrative costs ($1,250,000 in 2013) would be reduced by 25 per cent because LMC would no longer have to pay large isolation bonuses to key personnel.

Transportation costs from Fargo to outside markets would remain at approximately $3.3 million next year. The effective corporate tax rate is 40 per cent.

If construction were to begin in the summer of 2014, the railway would be ready for use by January 2015. Before such a railroad could be built, LMC would have to obtain permission from the Territorial government and the town councils of Carlsbad and Fargo. It appears that some opposition may exist to this proposal from some members of the councils and various levels of government. Everyone is concerned about the impact of the railroad on the caribou calving grounds. On the other hand, building the railroad would create new employment opportunities in both towns and stimulate growth throughout the region. LMC has petitioned the federal government for a 50 per cent subsidy to offset the costs of building the railroad and buying the train. Early indications are that this request may be approved if approval is obtained from all other concerned parties.

Should the subsidy be granted, LMC would receive all revenue and incur all operating and maintenance costs of the railroad and train. However, only the cost of the railroad and train after the subsidy would be subject to depreciation and capital cost allowance.

Required:

a) Determine the optimal yearly production plan for the ore processed by the Luna Mining Company.

b) Analyze the economic feasibility of building the railroad, and outline arguments the company could present to the municipal town councils, the territorial government and the federal government in order to acquire permission to build the railroad and receive the 50 per cent subsidy.

c) Prepare a budgeted income statement before taxes for LMC for 2015, and determine the pretax profit on sales percentage. Assume the following:

i) Current price levels remain unchanged.

ii) The federal government grants LMC a 50 per cent subsidy for the railroad and train capital costs.

iii) The railroad is fully operational by January 2015.

iv) LMC continues to process 1.2 million tons of ore per year following the optimum yearly production plan that you determine in part (a) above.

d) Explain how long-term uncertainty concerning the prices of precious metals would affect the following:

i) the capital budgeting decision of LMC

ii) the request for a government subsidy