Reference no: EM131247322

Southern Electric Power Company

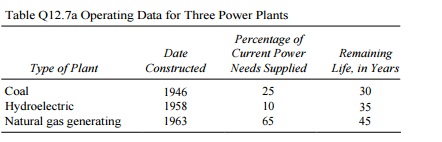

The State Public Service Commission (PSC) is charged with the responsibility of regulating the two large public utility companies in the state. The PSC is composed of seven persons; four elected, one gubernatorial appointee, and one representative each from the two public utilities. The PSC is currently considering a capacity expansion program submitted by Southern Electric Power (SE). SE operates three power plants, as shown in Table Q12.7a.

The population in the area served by SE has been growing 2% per year. This trend is expected to continue for at least the next 10 years. Industrial growth is even more rapid about 4% per year. As a result, demand for electricity is growing at approximately 3% per year. Peak-load demand is very near SEs capacity, so it is necessary to begin some expansion within the year.3

Another problem the company is confronted with is the growing shortage of natural gas. Last year SE was unable to buy enough natural gas to meet the full electric power needs of the area. The company was able to buy electricity generated by a company in an adjoining state that has coal, but there is no assurance that this source of power can be relied on in the future.

Given the uncertainty of future natural gas supplies, and the fact that hydroelectric power is already being fully utilized, SE feels the only sensible course is to expand its own coalgenerating capacity. This would be especially desirable since it would use the large soft-coal deposits in the northern part of the state. There are two ways to increase the capacity for coal generation. For $40 million it would be possible to double the generating capacity of the existing plant. This would fully satisfy the growing demand for electricity for the next 6 to 8 years, after which time additional capacity would be needed. The expansion would have a useful life of 30 years. The existing plant is located 20 miles from the center of the largest city in the state. In 1946, when the plant was originally built, the location was selected specifically to be at a considerable distance from any populated area so that the smoke produced by burning coal would not be an environmental nuisance.

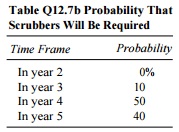

In 30 years the city has grown considerably. Heavily populated suburbs are now located within four miles of the plant, and pollution created by SE is a growing political issue. The company believes it probable that within the next 5 years political pressure will require that smoke scrubbers be installed at the existing plant (Table Q12.7b). Scrubbers can be installed any time at the existing plant for $4 million If plant capacity is doubled and scrubbers are installed at that time, the total cost would be $5.5 million. (This would be in addition to the base cost of the new plant discussed below.) If the installation of scrubbers is postponed, and carried out as a separate capital investment, the total cost is estimated to be $8 million, subject to the same probability that installation might never occur (see Table Q12.7b)

The alternative to expanding the capacity of the old plant is to build an entirely new plant. Such a plant would cost $110 million and would have a maximum capacity of three times the existing coal plant. With the new capacity in addition to the existing plant, energy needs could be met for the next 18 to 20 years. The useful life of the plant would be 40 years. If desired, the capacity of the new plant could be increased to the point that the old plant could be abandoned and capacity would still be adequate for the same period.

The additional cost of the extra capacity would be $22,082,000, which would be depreciated over the full life of the plant. If the old plant is abandoned, equipment worth $7 million could be used in the new plant, and sale of the land would provide additional capital of $3 million. Annual operating costs of the old plant are $2 million. If its capacity is doubled, operating costs will rise by $1.5 million Cost of operating the new plant will be $4 million per year. If the old plant is abandoned, operating costs of the new plant will increase by $450,000 per year for the remaining life of the old plant. SE uses straight-line depreciation to zero salvage value on all capital investments discussed here. The cost of scrubbers is amortized over the remaining life of the plant in which they are installed. Book value of the existing coal plant is $10 million. SE has an effective tax rate of 40%. SEs weighted average cost of capital is 10%. Revenues and other costs will be the same under either alternative. Excess capacity can be sold outside the state at the same rate as within the state.

1. As a representative of the utility company, you are concerned with maximizing the present value of the project. Analyze the alternatives and indicate your recommendation.

2. Keeping in mind that you are working only with costs, how would you adjust the discount rate to account for: (a) the extra uncertainty for any alternative that includes delayed installation of smoke scrubbers; (b) the pollution that would result from operating the old plant without smoke scrubbers?

3. How would these factors affect your recommendation? As an elected member of the PSC, what factors would you include in your analysis of the project? How would each of these factors bear on your decision?

|

Process impact the outcome of the event

: Think about the last event you had to plan for either at work or in your personal life. Did you have a process? How did having or not having a process impact the outcome of the event?

|

|

How the pressure p will change when fluid velocity double

: Make use of dimensional analysis to determine how the pressure, p, will change when the fluid velocity, V, is doubled.

|

|

What are the sources of monopoly power

: What are the sources of monopoly power

|

|

Understanding of corporations may raise

: One of the implications of the notion that corporations are agents is that, in some sense or another, corporations can be understood as persons or even citizens. What are some problems or concerns that such an understanding of corporations may rai..

|

|

Analyze the alternatives and indicate your recommendation

: As a representative of the utility company, you are concerned with maximizing the present value of the project. Analyze the alternatives and indicate your recommendation.

|

|

Determine a suitable set of pi terms

: Assume that the power, required to drive a fan is a function of the fan diameter, D, the air density, ρ, the rotational speed,ω, and the flow rate, Q. Use D, ω, and ρ as repeating variables to determine a suitable set of pi terms.

|

|

Find its value for water flowing at a velocity

: The Reynolds number, ρvd/μ, is a very important parameter in fluid mechanics. Verify that the Reynolds number is dimensionless, using both the FLt system and the MLt system for basic dimensions, and determine its value for water flowing at a veloc..

|

|

Indicating any critical points

: Sketch the graph of f(x) = 4x^3 - x^4, clearly indicating any critical points, points of inflection, intervals on which f is increasing or de- creasing, intervals on which f is concave up or concave down and x- and y-intercepts.

|

|

Discuss the implications of large and small sample sizes

: Discuss the implications of large and small sample sizes to include pros and cons, possible tests that might be used to analyze the data, and how parametric and nonparametric data affects the study.

|