Reference no: EM132811021

Kaggle's New York Stock Exchange

Introduction

In this project we will analyze real life data from the New York Stock Exchange. You will be drawing a subset of a large dataset provided by Kaggle that contains historical financial data from S&P 500 companies. We have created a smaller subset of the data that you will be using for the project.

Background:

We used the Fundamentals.csv and Securities.csv files provided by Kaggle. The Fundamentals file provides the fundamental financial data gathered from SEC 10K annual filings from 448 companies listed on the S&P 500 index. The Securities file provided the industry or sector information the companies are categorized under on the S&P 500 index.

What skills will I use?

The main goal of this project is for you to demonstrate your ability to:

• interpret the measures of central tendency and spread (mean, median, standard deviation, range)

• use a combination of Excel or Google Sheets functions (e.g., IF statements, INDEX and MATCH, calculating descriptive statistics with the IF statement, drop downs, data validation, VLOOKUP).

• analyze and forecast financial business metrics using Excel or Google Sheets.

• create visualizations of a business metric and use Excel or Google Sheets to create a financial forecast model.

Project Set Up

This project is made of two parts. For each part, you will be using the same dataset, which you can find in the Supporting Materials as Projectdata NYSE.csv at the bottom of this page. If you are using Google Spreadsheets, you can access the link to the data here:

1. The first part of the project is a set of quiz questions, which you will find in the upcoming concepts. These concepts are aimed to help you get familiar with the dataset and test that you have mastered the core concepts in the previous lessons. Correctly answering each of the quiz questions will assure you are on the right track before you dive into the second part of the project. This part of the project will not be submitted for review.

2. The second part of your project is the portion you will turn in for review. You will need to create a presentation and spreadsheet to be reviewed. The details of this submission are provided in the last page in this lesson. Pay attention to the details of the Rubric to assure you have all deliverables. In order to have your presentation reviewed, you will need to save your slides as a PDF. You can save your spreadsheet as a Microsoft Excel workbook or Google spreadsheet.

Cleaning Up The Data

Although you do not need to follow these for setting up the dataset, these are some suggestions:

1. Change all the column names to have no spaces, but still be informative. This isn't necessary, but just a recommendation. Depending on what you do with the data in the future having spaces or special characters in the column names may not work nicely. You will see this in the next content on SQL.

The following information is included in the Project data NYSE file:

• Ticker symbol: Stock symbol

• Years: Number of years for which data is provided

• Period ending

• Total revenue

• Cost of goods sold

• Sales, General and Administrative expenses

• Research and Development expenses

• Other Operating expense items

• Global Industry Classification Standard (GICS) Sector: Industry sector the company is categorized under (e.g., American Airlines with the ticker symbol AAL is categorized under Industrials.)

• GICS Sub Industry: Sub-industry sector the company is categorized under (e.g., AAL is further categorized under the sub-category of Airlines industry.)

QUESTION 1

Which company posted the maximum total revenue in any individual year?

• WMT

• AAPL

• CVX

• EXR

QUESTION 2

Match the mean of Total Revenue across all the companies for each of the calendar years for which we have data.

2016

2015

2014

2012

2013

MEAN OF TOTAL REVENUE

YEARS

$18,243,540,884.96

$20,304,113,413.30

$21,113,807,543.06

$20,371,836,512.88

$24,577,107,967.14

QUESTION 3

Now calculate the descriptive statistics for the Total Revenue column for all the companies across all years. Based on the descriptive statistics for Total Revenue, which of the following conclusions are true?

• The mean is the same as the median for Total Revenue.

• The distribution for Total Revenue is positively or right-skewed.

• Fifty percent of the Total Revenue amounts reported are higher than $9,968,000,000.

• The mean is higher than the median for Total Revenue.

• Fifty percent of the Total Revenue amounts reported are higher than $8,077,927,500.

QUESTION 4

Now calculate the descriptive statistics for R&D expenses for the whole data set. Based on the descriptive statistics for R&D expenses, which of the following conclusions are true?

• Fifty percent of reported R&D expenses equal $0.

• The median is equal to the mode.

• The graph representing R&D expenses is positively or right-skewed.

• More than 75% of the reported R&D expenses are less than $95,750,000 .

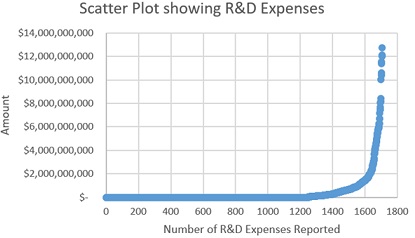

As you can see from the scatter plot below, the distribution is not a normal distribution. The majority of financial statements for all companies report $0 are spent on R&D expenses.

EXPLORING THE DATA

QUESTION 1

Which two columns should you use to create a column for gross profit?

• Total revenue

• Other operating items

• Cost of goods sold

QUESTION 2

Which expenses should be included in the Total Operating Expenses?

• Sales, General and Admin.

• Other operating items

• Research & Development

QUESTION 3

What is the Operating Income reported by EBAY in 2014?

• $7,127,000,000

• $3,459,000,000

• $2,476,000,000

QUESTION 4

Which of these metrics are commonly used to forecast financial models?

• Revenue growth

• Operating margin

• Gross margin

• Cost of Goods Sold

QUESTION 5

Match the formulas for each of the following concepts.

= [1-(Cost of Goods Sold/Total Revenue)]

= Prior year's revenue x (1 + Revenue Growth)

[Operating Income/Total Revenue]

[Cost of Revenue/Total Revenue]

[Operating Margin * Total Revenue]

[Total Operating Expenses/Total Revenue]

CONCEPT

FORMULAS

Forecast for Total Revenue

Gross Margin

Operating Margin

Forecast for Operating Income

SUBMIT

NEXT

How Do You Complete this Project?

This project is connected with the Introduction to the Data part of the course, but depending on your background knowledge, you may not need to take this module to complete this project.

Introduction

For the final project, you will conduct three tasks: 1) complete your own data analysis and create a presentation to share your findings, 2) develop a dashboard for a Profit and Loss Statement, and 3) create a Financial Forecasting Model using three scenarios. You should start by taking a look at your dataset and brainstorming which sub-category and company you want to focus your data analysis on - the questions leading to this page should have assisted in this process! Then you should use spreadsheets or another Excel-like software to conduct your analysis and choose a sub-category and company you are most interested in. This project is open-ended in that there is no one right answer.

Project Goals:

Here are the three tasks that you will complete in the final project.

Task 1:

a. Identify the question about the data that you will answer based on your data analysis, and include this in your slide presentation.

• Your question should include at least one categorical variable (GICS Sector or GICS Sub Industry) and one quantitative variable (one of the financial metrics) and require the use of at least one of the summary statistics.

• A tab within the Excel spreadsheet that you submit should include the summary statistics [measures of central tendency (e.g., mean, median) and measures of spread (standard deviation and range)] you used to answer your question.

• Deliverable: Slide presentation, Spreadsheet with tab for Summary statistics

b. Your slide presentation should provide at least one visualization to help with your answer.

• This visualization might be a bar chart, histogram, scatterplot, box-plot or other visual that you learned to make. Include your insights from the measures of center and spread and at least one numeric summary statistic in the description.

• Deliverable: Slide presentation (includes visualization)

Task 2:

• Create a dashboard for a Profit and Loss Statement that calculates the Gross Profit, Operating Profit or EBIT for a company selected from a drop-down list.

• Your drop-down list should pull historical fundamentals data to create the P&L Statement.

• The P&L statement should include the Gross Profit, Operating Profit or EBIT values for all the years there is historical data available for that company in the dataset.

• Deliverable: Spreadsheet with tab for Dynamic P&L statement

Task 3:

• Create a financial model for a company (different from Task 2) of your choice that forecasts out the Gross Profit, Operating Profit or EBIT for two more years using three scenarios (Best case, Weak case and Base case).

• Your assumptions for revenue growth, gross margin and operating margin should change for each scenario.

• The forecasting model should be dynamic for the selection of the case (Weak, Base, Strong). However, the forecasting model can be static for the chosen company sticker symbol.

• Deliverable: Spreadsheet with tab for Forecasting Model

Step One - Get Organized

When you complete your analysis and presentation you'll want to submit your project. Get organized before you begin. I recommend creating a single folder that will eventually contain:

• The presentation with the visual and summary

• The original data set

• A copy of the spreadsheet workbook you will use to do the analysis for your report that contains at least the following tabs:

1. Data file

2. Summary statistics

3. P&L Statement Dashboard

4. Forecast scenarios

Step Two - Analyze Your Data

Look through the Tasks described above and select the qualitative variable and quantitative variable you want to focus your analysis on for the various tasks. Then use the .csv file to conduct your data analysis.

Step Three - Create Your Presentation

Once you have finished analyzing the data, create a presentation that shares the visual and summary paragraph. The summary paragraph should clearly communicate your findings based on your analysis, and provide visual or numeric values associated with your summary.

The submission template is a Google Slides file. Make a copy of the submission template to complete your project. We suggest you use the layout provided, though it is not a requirement.

Step Four - Assemble your Worksheet You will need to include the Excel file with the summary statistics, dashboard and financial model scenarios.

Put your presentation and spreadsheet workbook you used to do the analysis in a folder and zip it. Then submit the zipped folder for your project.

Step Five - Check the Rubric

Use the Project Rubric located here. If you see room for improvement, keep working to improve your project.

Step Six - Assemble your folder ready for submission

If you are happy with your submission, then you're ready to submit your project. Put your presentation and spreadsheet workbook in a folder and zip it. Then submit the zipped folder for your project.

The above slide and graphs were generated with the project data and are meant to be examples. You can see how this example slide meets the rubric requirements.

1. Clear question in the title indicating what is being investigated

2. Descriptive title on each chart describing its contents

3. y-axis title

4. x-axis title

5. Detailed insight based on the descriptive statistics.

6. Summary statistics about the data

Attachment:- New York Stock Exchange.rar