Reference no: EM131705027

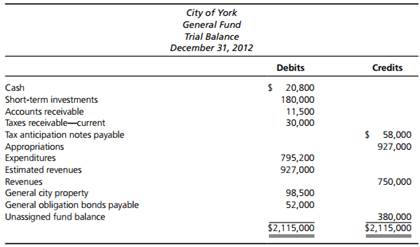

Question: (Review problem-correction of errors and adjusting entries) As the recently appointed chief accountant of the City of York, you asked the bookkeeper for a trial balance of the General Fund as of December 31, 2012. (York uses only a General Fund to record all its transactions.) This is what you received:

After glancing at the trial balance, you realize that the inexperienced bookkeeper made errors on some transactions and merely guessed at the correct accounting treatment of other transactions. This is what you found when you reviewed the journal entries and analyzed other transactions and events that had occurred during the year:

1. On December 1, 2012, the city received notice from the state that it would receive a grant to help train its police officers. The grant terms stipulated that, to be eligible for the grant, the city would need to incur certain allowable costs. The city received a check for $20,000 on December 10 as an advance on the grant. The bookkeeper recorded the advance in the Revenues account. As of December 31, however, the city had not yet started the training program.

2. On December 31, 2012, the state department of tax and finance advised the city that the state had collected $58,500 of sales tax revenues on behalf of the city and that a check would be sent to the city by January 20, 2013. No journal entry was made for this information.

3. York collects property taxes on behalf of the county in which it is located. The entire amount received in November 2012 ($15,000) was recorded as York's revenues and was not sent to the county.

4. Analysis of the Taxes receivable-current account shows the following:

a. The entire $30,000 of receivables is delinquent.

b. Based on the history of delinquent tax collections, you estimate that $15,000 of the receivables will be collected by the end of February 2013, that $12,000 of the receivable amount will not be received until later in 2013, and that $3,000 will ultimately need to be written off as uncollectible.

5. Analysis of the account General obligation bonds payable shows that the debit balance of $52,000 arose from a journal entry made on December 30, 2012, to record a payment of debt service ($40,000 bond principal and $12,000 interest).

6. Analysis of the account General city property shows that the $98,500 debit balance resulted from two journal entries:

a. Sale of used truck for $6,400

b. Purchase of new firefighting equipment for $104,900

7. Although the city's actuary estimated that the city would need to contribute $45,000 to its pension fund for the year, the York City Council decided not to make an appropriation for it because the city needed to conserve its cash. The bookkeeper decided that there was no need to make an accrual.

8. Two lawsuits were brought against the city as a result of damages caused by its trucks during trash collection. One case was settled in late December, for which York will pay $2,000 damages in January 2013. The city attorney believes the city will probably lose the other case as well and may need to pay out $6,000 to settle it. However, the case is complex and is not likely to be resolved for another 15 months. The bookkeeper didn't think any entry was needed because no cash was paid. Prepare journal entries, as necessary, to correct the City of York's records. Record all adjustments to the revenue and expenditure accounts as simply "revenues" or "expenditures" without showing details. Make the adjusting journal entries in the General Fund only. If some other fund would normally be used to record the transaction, however, state which one would be used.