Reference no: EM132514253

AFE5013-B Multinational Finance and Investment - University of Bradford

Problem 1. Capital markets

Answer the following independent questions:

a) Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the market index S&P500 over the same periods were -15% and 28%. Calculate the beta for Coca-cola.

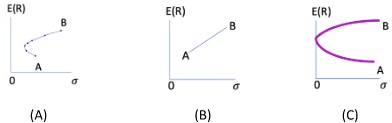

b) The covariance between stocks A and B is 0.0014, standard deviation of stock A is 0.032, and standard deviation of stock B is 0.044. Which of the following is the most appropriate to depict the risk-return characteristics of a portfolio consisting of only stocks A and B, and explain why?

c) Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (βA) tobeta of B (βB).

d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to pay returns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standard deviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also has standard deviation equal to 20% and has correlationof 0.5 with the S&P500. Determine whether asset A and B are overvalued or undervalued, and explain why.

Problem 2. Foreign exchange markets

Statoil, the national company in Norway, is a large, sophisticated, and active participant in both the currency and petrochemical markets. Although it is a Norwegian company, because it operates within the global oil market, it considers the U.S. dollar ($), rather than the Norwegian krone (Nok), as its functional currency. Ari Karlsen is a currency trading strategist for Statoil. Answer the following two independent questions a) and b):

a) Statoil sold 1 million barrels of crude oil to the Norwegian petrol station chain, Circle K, today for 120 Nok per barrel (Nok denotes the Norwegian Krone). Statoil expects to receive the full payments from Circle K in 3 months' time when the crude oil is delivered to Circle K's facilities in Norway. Statoil is informed that Circle K will pay for the oil in Norwegian Krone. Ari is asked by the Chief Financial Officer (CFO) about thestrategy to reduce the uncertainty around the expected payment from Circle K. Ari is faced with the following market rates:

|

Spot exchange Rate

|

Nok 6.0312/$

|

|

3-month forward rate

|

Nok 6.0186/$

|

|

U.S. dollar 3-month interest rate

|

5%

|

|

Norwegian Krone 3-month interest rate

|

4.45%

|

Based on the above information, what hedging strategy should Ari advise the CFO that works the best for Statoil? Explain why Ari should choose such hedging strategy. How much U.S. dollar will Statoil receive at the end of 3 months by using this hedging strategy? (20 marks)

b) In a daily meeting, the Chief Financial Officer (CFO) gave Ari the following table of market rates

|

Spot exchange rate:

|

Yen 106/$

|

|

U.S. dollar interest rate per annum

|

10%

|

|

Japanese Yen interest rate per annum

|

6%

|

and told Ari that the company's financial analyst expected the Japanese Yen to depreciate against the U.S. dollar by 3.46% in 90 days. Assume there are 360 days in a year, and all interest rates are simple interest rates.If the financial analyst's prediction about the US dollar and Japanese Yen turned out to be true:

b.1) What would the spot exchange rate (Yen/$) be in 90 days?

b.2) Would Ari make a profit by borrowing 1 million US dollar and investing in the money markets?

If yes, how much profit would Ari realize in 90 days?

If no, explain why.

Problem 3. Bond

Consider a bank with the following balance sheet (M means million):

|

Assets

|

Value

|

Duration of the Asset

|

Convexity of the Asset

|

|

5yr bondbought at a yield of 3.4% (lending money)

|

$550M

|

4.562

|

12.026

|

|

12yr bondbought at a yield of 4% (lending money)

|

$800M

|

9.453

|

53.565

|

|

Liabilities

|

Value

|

Duration of the Liability

|

Convexity of the Liability

|

|

2yr bondsold at a yield of 2.4% (borrowing money)

|

$300M

|

1.941

|

2.384

|

|

4yr bondsold at a yield of 2.8% (borrowing money)

|

$500M

|

3.759

|

8.206

|

a) Calculate the equity (total asset - total liability) to asset ratio of the bank

b) Calculate the duration and convexity of the both asset and liability sides;

c) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio;

d) In c)'s scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero duration and zero convexity) from the equity holders. How much cash does the bank need to raise?

e) Do you agree with the following statement? Explain why.

"The information about a bond's duration and convexity adjustment is sufficient to quantify interest rate risk exposure."

Attachment:- Multinational Finance and Investment.rar