Reference no: EM132498637

AFE5004-B Management Accounting - University of Bradford

Problem 1

Bradford Watch Company manufactures luxury and sports watches both for male and female customers. The luxury watches are famous for the high-end design materials while the sports watches are popular for their utilities.

The company uses a traditional costing system in assigning overhead costs to the products on the basis of direct labour hours. However, the Production Manager seeks to replace the existing system with the Activ-ity-based Costing (ABC) system to keep control over costs and offer more competitive pricing. After re-viewing the existing costing system and interviewing the company's personnel in relevant departments, the accountant compiled a report highlighting resources and costs involved in manufacturing watches per month:

1. The following table lists out the overhead cost:

| Activity cost pool |

Overhead cost (£) |

Additional Notes |

| Job-order set up |

33,000 |

|

| Procurement and placement |

360,000 |

|

| Installation of winding system |

195,000 |

An auto winding system is fitted with every watch |

| Quality inspection (machine) |

60,000 |

|

| Quality inspection (manual) |

21,000 |

|

| Finishing |

140,000 |

Hand-made finishing |

| Packaging and delivery |

44,250 |

The company packages and delivers watches in batches containing 10 watches per batch. On an average, the packaging and delivery cost is the same for all batches (10 watches= 1 batch) |

| Factory cleaning services |

30,000 |

A cost that is not consumed by any of the products |

2. The company pays £8 per direct labour hour

3. The following table lists out some key figures for this firm:

| Description |

Quantity |

| Number of watches |

1,500 units |

| Direct labour hours |

7,000 hours |

| Machine hours |

14,000 hours |

| Number of job orders |

110 |

| Inspection hours using machine |

800 hours |

| Number of cycles for procurement and placement |

2,400 times |

Required:

a) Calculate the manufacturing overhead absorption rate using the traditional absorption costing system

b) What would be the sales price of the following two products using the ABC system if the company adds 30% mark-up on total allocated costs?

| Model |

Luxury |

Sports |

| Category |

Female |

Male |

| Job order number |

LF-340& LF-341 |

SM-119& SM-120 |

| Number of units |

30 |

50 |

| Direct materials (£ per unit) |

85 |

55 |

| Direct labour hours |

200 |

250 |

| Machine hours |

225 |

750 |

| Inspection hours using machine |

12 |

40 |

| Number of cycles for procurement and placement |

50 |

80 |

c) Given the value in a) and b), please brief explain the differences between traditional absorption costing approach and Activity Based Costing (ABC) approach.

d) Discuss how allocation of customer-related overhead cost can lead to better decision making within firms with reference to the case below.

‘An insurance company, A-Insure Limited, decided to use CPA to identify profitable and non-profitable customers after it grew concerned about the poor financial performance of one of its policy options. A-Insure collected customer data through original policy proposal forms which were stored electronically in a customer database. It was able to conduct a complex cross correlation between known cost drivers and the demographic and other characteristics of policy holders. The cost drivers were:

• commission payments to financial advisers who sold the policy

• early surrender of the policy by the policy holder

• changing of bank details and consequent chasing of missed premiums

• responding to customer queries.

The analysis identified that the policy was unprofitable when sold to recently retired clients but was profitable when sold to other client segments. Recently retired customers had more time to review and consider changes to their insurance policies and to make queries. In response, the company reduced agents' com-missions on the policies according to the age of the policyholder to discourage them from selling to the non-profitable client segment.

Most companies have a customer database that can be mined for information to identify customer segments. If companies do not have the software to perform detailed CPA, specialist software can be purchased from many business software vendors.'

e) Briefly discuss the consequences and meaning of the Jump at Point A and the cap at Point B in the graph below.

Problem 2

Part 1 Liverpool Manufacturing Limited

Liverpool Manufacturing Limited developed the following standard costs for direct material and direct labour for one of their major products, the 45 litres heavy-duty plastic container. Each container requires the following:

| Types of Cost |

Standard quantity |

Standard price |

| Direct materials |

0.2 kilos |

£30 per kilo |

| Direct labour |

0.1 hours |

£17 per hour |

During June, Liverpool Manufacturing Limited produced and sold 10,000 containers using 2,100 kilos of direct materials at an average cost per kilo of £25 and 1,100 direct labour hours at an average wage of £16 per hour.

Required:

a) Calculate the following variances for June:

i. Direct material price variance

ii. Direct material quantity variance

iv. Direct labour rate variance

v. Direct labour efficiency variance

b) Briefly comment on the material and labour variances calculated in a)

c) Evaluate the importance of standard costing in budgeting process within firms

Part 2 Spanish Watch Company

The Spanish Watch Company has two divisions and manufactures one type of watch. The two divisions are the production Division and the Package & Delivery Division. The production Division manufactures watches and then sellsthem to the Package & Delivery Division, which packs the watchesand sells them to retailers. The market price for the Package & Delivery Division to purchase thiswatch is £40.

| Production's cost per watch are: |

£ |

| Direct materials |

6 |

| Direct labour |

7 |

| Variable overhead |

5 |

| Division fixed cost |

2 |

|

|

| Package & Delivery's cost per watch are: |

£ |

| Direct materials |

9 |

| Direct labour |

3 |

| Variable overhead |

4 |

| Division fixed cost |

16 |

Required:

a)Assume the transfer price for a watch is 160% of full costs of the Production Division and 100,000 watches are produced and sold to the Package & Delivery Division. What is the Production Division's operating income?

b)If the Package & Delivery Division purchases 100,000 watches from production departments and sells to retailers at a price of £150 per watch, what is the operating income of Spanish Watch Company?

c)If Production Division has excess capacity to produce 100,000 watches which it cannot sell externally, must it negotiate a transfer price below £40 per watch internally? If the production division cannot negotiate the appropriate transfer price with internal package and delivery division, what is the consequence of this? Explain.

d)Calculate and compare the difference in overall corporate net income between Scenario A and Scenario B if the Production Division sells 100,000 watches to retailers for £120 per watch.

a. Scenario A: Negotiated transfer price of £30 per watch.

b. Scenario B: Market-based transfer price of £40 per watch. Explain fully.

Part 3 Target costing

A target cost is 'a product cost estimate derived by subtracting a desired profit margin from a competitive market price. (CIMA, 2005).

Required:

The target costing is cost management techniques, and discuss the advantages of using this technique within firms.

Problem 3

Answer ALL PARTS OF QUESTIONS

a)A company manufactures a single product.

Unit costs are: $/Unit

| Variable production cost 14.75 |

Fixed production 8.30 |

| Variable selling 2.60 |

Fixed selling 5.45 |

400,000 units of the product were manufactured in a period, during which 394,000 units were sold. There was no inventory of the product at the beginning of the period.

Required:

1) Use Marginal costing to calculate the total value of the finished goods inventory at the end of the period.

2) Many firms have decided to use marginal costing to prepare the income statement. Please briefly explain the benefits of using marginal costing.

b) Newcastle Ltd manufactures and sells T-shirts imprinted with college names and slogans. Last Year, the shirts sold for £7.50 each, and the variable cost was £2.25 per shirt. The company needed to sell 20,000 shirts to break even. The net operating profit last year was £8,400. The company's expectations for the coming year include the following:

1. The selling price per T-shirt will increase by £1.50

2. Variable cost will increase by one third

3. Fixed cost will increase by 10%

If Newcastle Ltd wishes to earn £22,500 in net operating profit for the coming year, how muchsales does this company have to make?

c) The production department of Y Company is planning to purchase a new machine to improve product quality. The company's management accountant is currently evaluating two options- Buy the machine OR Rent it. Following information is available:

I. The company has to pay £3,200 to set up the machine. Insurance cost £450 per annum.

II. If it is bought, the new machine is depreciated on reducing balance basis at the rate of 25%. After various calculations, the company has to pay £4,200 maintenance cost every year and estimated repair cost would be £300 per year. The firm will have to sell old machines, which had cost £65,000 six years ago. Apart from the above information, the £500 of delivery cost is incurred for this purchase option.

III. If it is rented, £ 4,650 per year to pay as rent. There is no cost for repair and maintenance. However, the firm is required to pay the administration charge of £650 with this rent option. For rent option, the delivery cost remains at 20% of the £ 500 (the delivery cost for purchase option). For the rent option, firm is not going to sell old machines.

Should the company buy or rent new machine?

d) In Management Accounting, there are some investment appraisal methods to analyse the performance of investment projects. The following table lists out the financial data of two projects for London Technology Ltd:

| Projects/Methods |

A |

B |

| Payback Period |

2 year and 4 months |

2 year and 9 months |

| Accounting Rate of Return |

27.60% |

15.44% |

| Net Present Value |

£23,040 |

£21,798 |

Required:

Which project should company accept? In the discussion, please explain which method can leads to better decision.

e) The manager of a tourist attraction is considering whether to open on 1 January, a day when the attraction has, in previous years, been closed. The attraction has a daily capacity of 1,000 visitors. If the attraction opens for business on that day it will incur additional specific fixed costs of $30,000.

The contribution from the sale of tickets would be $25 per visitor. The number of visitors is uncertain but based on past experience it is expected to be as follows:

| Number of Visitors |

Probability |

| 800 visitors |

50% |

| 900 visitors |

30% |

| 1,000 visitors |

20% |

It is expected that visitors will also purchase souvenirs and refreshments. The contribution which would be made from these sales has been estimated as follows:

| Spending per Visitors |

Probability |

| $8 per visitor |

35% |

| $10 per visitor |

40% |

| $12 per visitor |

25% |

Required:

Calculate whether it is worthwhile opening the tourist attraction on 1 January. You should use expected value as the basis of your analysis.

f)‘Process costing is a term used in cost accounting to describe one method for collecting and assigning manufacturing costs to the units produced.' There are some statements about the process costing:

1. An abnormal loss occurs when expected output exceeds actual output.

2. The scrap value of an abnormal loss is credited to the process account.

3. The allocated cost of an abnormal gain is credited to the process account.

4. The inputs to a process less the normal loss is the expected output.

5. The normal loss in a process is allocated a cost in order to reconcile the costs of inputs and outputs.

6. The FIFO method assumes opening WIP is the first group of units to be completed. Therefore, opening WIP is charged separately to completed production and CPU is based on current period costs.

Required:

Please identify which of the above statements are false and explain the reasons.

Problem 4

Please read the following instructions:

Please write your answer in the form of report for these twotheoretical questions. Your Report should have the proper structure: Introduction, Main Body and Conclusion. Your discussion for each Problem should be around 550-600 words. There is no right or wrong answer for these two theoretical questions. The academic reference is required for both questions, preferably at least three references for each of the question.

Note: If you fail to follow the above instructions, the penalty will apply.

Please answer the following questions:

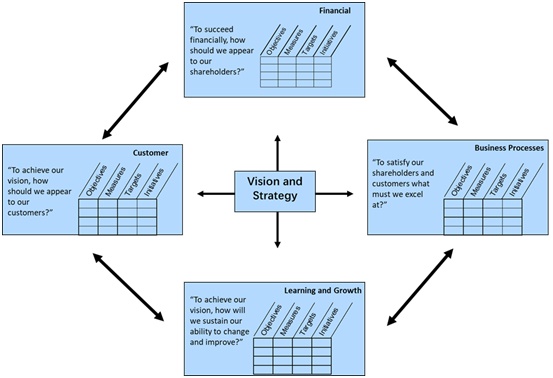

a) Many academic scholars believed that ‘Strategic information must be in balance with operational infor-mation about an enterprise. Thus the balanced scorecard is the most useful management accounting tool.'

Required:

Please critically discuss the above statement with reference to academic literature. In your discussion, you should also refer to Kaplan and Norton BSC model (1992) below.

b) ‘Budgeting has a number of different purposes including: Planning; Control; Performance evaluation; Mo-tivation. Some managers believe that zero-based budget is more beneficial than other types of the budgetfor firms.'

Required:

Critically discuss the above statement with reference to academic literature. In your discussion, you should refer to the budgeting systems you learned in this module.

Attachment:- Management Accounting.rar