Reference no: EM13316936

Periwinkle Pty Ltd (Periwinkle) is a bathtub manufacturer which sells bathtubs directly to the public. On 1 May 2013, Periwinkle provided one of its employees, Emma, with a car as Emma does a lot of travelling for work purposes. However, Emma's usage of the car is not restricted to work only. Periwinkle purchased the car on that date for $33,000 (including GST).

For the period 1 May 2013 to 31 March 2014, Emma travelled 10,000 kilometres in the car and incurred expenses of $550 (including GST) on minor repairs that have been reimbursed by Periwinkle. The car was not used for 10 days when Emma was interstate and the car was parked at the airport and for another five days when the car was scheduled for annual repairs.

On 1 September 2013, Periwinkle provided Emma with a loan of $500,000 at an interest rate of 4.45%. Emma used $450,000 of the loan to purchase a holiday home and lent the remaining $50,000 to her husband (interest free) to purchase shares in Telstra. Interest on a loan to purchase private assets is not deductible while interest on a loan to purchase income-producing assets is deductible.

During the year, Emma purchased a bathtub manufactured by Periwinkle for $1300. The bathtub only cost Periwinkle $700 to manufacture and is sold to the general public for $2,600.

(a) Advise Periwinkle of its FBT consequences arising out of the above information, including calculation of any FBT liability, for the year ending 31 March 2014. You may assume that Periwinkle would be entitled to put input tax credits in relation to any GST-inclusive acquisitions.

(b) How would your answer to (a) differ if Emma used the $50,000 to purchase the shares herself, instead of lending it to her husband?

Part 2: Question

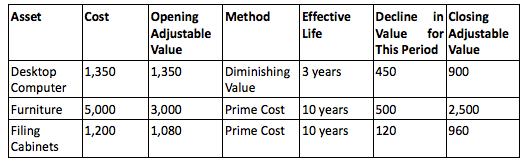

An extract of the asset register of Alpha Pty Ltd ('Alpha') for the 2012-13 income year is as follows:

All depreciable assets are for 100% business use and Alpha uses a low-value pool for all eligible assets. The closing value of the low-value pool at 30 June 2013 was $5,300. Alpha purchased a printer on 5 June 2014 for $700. Advise Alpha of the income tax consequences arising out of the above information for the 2013-14 income year.

|

Write a function that produces of positive prime numbers

: Write a function that produces a stream of positive prime numbers. Use that stream to create a list of the product of all pairs of consecutive prime numbers up to a given value.

|

|

What frequency do you hear after it passes by you

: A police car is moving towards you at a speed of 36.0 m/s. Its siren produces a frequency of 850 Hz. What frequency do you hear after it passes by you

|

|

Determine the axial forces in the members of the truss

: A cable is attached at A and is connected to the wall. Determine the axial forces in the members of the truss using the Method of Joints and indicate whether they are in tension (T) or compression (C). Be sure to provide complete free body diagram..

|

|

How far away was the lightning bolt

: Thunder is heard 4.0 sec after the flash of lightning is observed. If the outside temperature is 15 degrees celsius, how far away was the lightning bolt

|

|

Advise periwinkle of its fbt consequences arising out

: Advise Periwinkle of its FBT consequences arising out of the above information, including calculation of any FBT liability, for the year ending 31 March 2014 and how would your answer to (a) differ if Emma used the $50,000 to purchase the shares h..

|

|

Plot the two test results on a shear stress-normal stress

: At a confining pressure of 2000 psi, the first sample failed at 9000 psi. Then at a confining pressure of 5000 psi, the other sample failed at 21,000 psi. Plot the two test results on a shear stress-normal stress diagram and draw in Mohr envelope.

|

|

Calculate his break shot speed

: the top of a pool table is 0.770 m from the floor. the placement of the tape is such that 0 m aligns to the edge of the table. calculate his break shot speed

|

|

How many holes are required to break 250000 tons

: Conduct a powder factor design for the following conditions: -Rock is iron ore; density is 5370 lb/cubic yards -Rock swells 60% from in situ when broken -Bench height is 45ft -Drill hole diameter is 12.25 inches

|

|

Determine the increase in length of the wire

: A wire is 1.50 m long and has a diameter of 1.50 mm. The tensile modulus of the wire is 6.20 x 1010 N/m2. what is the increase in length of the wire

|