Reference no: EM13500641

Part 1: Case study

Periwinkle Pty Ltd (Periwinkle) is a bathtub manufacturer which sells bathtubs directly to the public. On 1 May 2013, Periwinkle provided one of its employees, Emma, with a car as Emma does a lot of travelling for work purposes. However, Emma's usage of the car is not restricted to work only. Periwinkle purchased the car on that date for $33,000 (including GST).

For the period 1 May 2013 to 31 March 2014, Emma travelled 10,000 kilometres in the car and incurred expenses of $550 (including GST) on minor repairs that have been reimbursed by Periwinkle. The car was not used for 10 days when Emma was interstate and the car was parked at the airport and for another five days when the car was scheduled for annual repairs.

On 1 September 2013, Periwinkle provided Emma with a loan of $500,000 at an interest rate of 4.45%. Emma used $450,000 of the loan to purchase a holiday home and lent the remaining $50,000 to her husband (interest free) to purchase shares in Telstra. Interest on a loan to purchase private assets is not deductible while interest on a loan to purchase income-producing assets is deductible.

During the year, Emma purchased a bathtub manufactured by Periwinkle for $1300. The bathtub only cost Periwinkle $700 to manufacture and is sold to the general public for $2,600.

(a) Advise Periwinkle of its FBT consequences arising out of the above information, including calculation of any FBT liability, for the year ending 31 March 2014. You may assume that Periwinkle would be entitled to input tax credits in relation to any GST-inclusive acquisitions.

(b) How would your answer to (a) differ if Emma used the $50,000 to purchase the shares herself, instead of lending it to her husband?

Part 2: Question

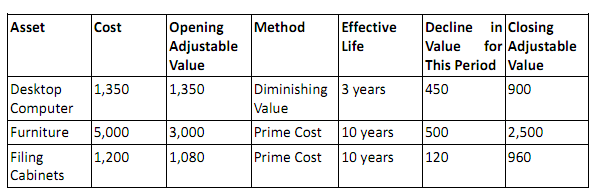

An extract of the asset register of Alpha Pty Ltd (‘Alpha') for the 2012-13 income year is as follows:

All depreciable assets are for 100% business use and Alpha uses a low-value pool for all eligible assets. The closing value of the low-value pool at 30 June 2013 was $5,300.

Alpha purchased a printer on 5 June 2014 for $700.

Advise Alpha of the income tax consequences arising out of the above information for the 2013-14 income year.

|

Calculate the flux through the shaded face of the cube

: There is a uniform magnetic field throughout the region with components Bx = +1.0 T, By = +9.0 T, and Bz = +2.0 T. Calculate the flux through the shaded face of the cube

|

|

Build community around the notion of sustainability

: Of the various elements in the promotion mix, which offers the greatest potential advantages to educate and build community around the notion of sustainability?

|

|

Estimate the unknown capacitance

: An isolated capacitor of unknown capacitance has been charged to a potential difference of 100V. Calculate the unknown capacitance

|

|

Eu directive on end-of-life vehicles

: Explain the term total customer cost; in your response, list and explain each of the components included under this term. How is the EU Directive on End-of-Life Vehicles related to this concept?

|

|

Advise alpha of the income tax consequences

: Advise Alpha of the income tax consequences arising out of the above information for the 2013-14 income year - advise Periwinkle of its FBT consequences arising out of the above information, including calculation of any FBT liability,

|

|

What is the mass of the man

: A man stands in the middle of a boat, which is 4.1 m long and has a mass of 75 kg. The end of the boat that is closest to land is 2.7 m from the shore. What is the mass of the man

|

|

The issue-attention cycle

: The issue-attention cycle, illustrates the time line from interest-decline and post-problem.

|

|

An exampled of a vertical marketing system

: Walmart is working with its suppliers, using tools such as electronic billing, purchase order verification, and bar code technology, to integrate data used to improve overall performance. Is this an exampled of a vertical marketing system?

|

|

What is the speed of the car traveling north

: A car is traveling east at 14m/s, weighing 2000kg. A car is traveling north at an unknown velocity, and weighs 1500 kg. What is the speed of the car traveling north

|