Reference no: EM13496201

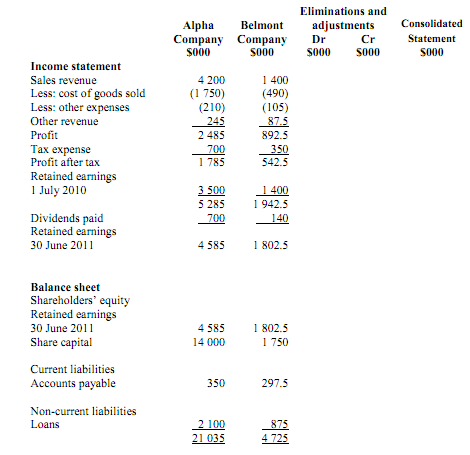

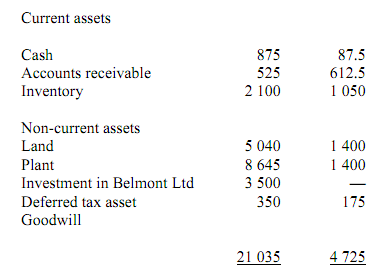

Alpha Ltd owns 100% of the shares of Belmont Ltd, acquired on 1 July 2010 for $3.5 million when the shareholders' funds of Belmont Ltd were:

Share Capital 1,750,000

Retained Earnings 1,400,000

3,150,000

All assets of Belmont Ltd are fairly stated at acquisition date.

The directors believe that there has been an impairment loss on the goodwill of $35,000 for the year ended 30 June 2011.

During the 2011 financial year, Belmont Ltd sells inventory to Alpha Ltd at a sales price of $700,000. The inventory cost Belmont Ltd $420,000 to produce. At 30 June 2011, half of the inventory is still on hand with Alpha Ltd.

The tax rate is 30%.

The accounts of Alpha Ltd and Belmont Ltd as 30 June 2011 are as follows;

Required

Prepare the consolidated journals for Alpha Ltd and its controlled entity for 2011

Use the above worksheet and complete the consolidated statement.

a. Determine goodwill or gain on acquisition

b. Eliminate inter-company sales transaction.

c. Eliminate unrealized profit in closing inventory

d. Adjust the tax expense for unrealized profit or losses

e. Eliminate dividend paid by Belmont to Alpha

f. Impair goodwill