Reference no: EM131014380

Comprehensive

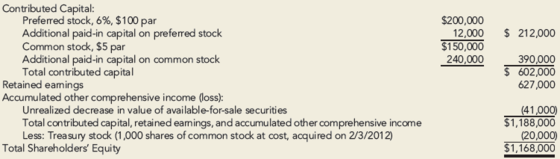

Included in the December 31, 2012, Jacobi Company balance sheet was the following shareholders' equity section:

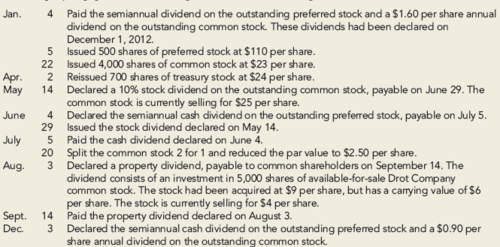

The company engaged in the following stock transactions during 2013:

Prepare the following:

Jan 4

Dividends; Preferred ______________

Dividends;Common ______________

Cash ________________

Jan 5

Cash _______________

Preferred Stock;$100 Par ______________

Additional Paid in Cap;Pref ______________

Jan 22

Cash _______________

Common Stock;$5 Par ________________

Additional Paid in Cap;Common ________________

April 2

Cash _____________

Treasury Stock ______________

Additional Paid in Cap;Treasury Stock ______________

May 14

REtained Earnings _____________

Common Stock to Dist _______________

Additional Paid in Cap;Stock Dividend _______________

June 4

Retained Earnings ______________

Dividends Payable: Preffered ________________

June 29

Common Stock to Dist _______________

Common Stock;$5 Par ________________

July 5

Dividends Payable;Preferred _______________

Cash _________________

July 20

Memo Entry ______________

Memo Entry __________________

August 3

Declare Dividend

Loss on Disposible Invest _______________

Unreal.decrease in Value Avail for sale Sec ________________

Allow. for change in value of invest. ________________

Dividend Payable (Aug 3)

Retained Earnings __________________

Property Dividend Payable _________________

Sept 14

Property Dividend Payable _________________

Allow for change in value of invest _________________

Investment in Drot Co. Stocks _______________

Dec 3

Retained Earnings __________________

Dividends Payable;Preferred _________________

Dividends Payable;Common __________________

PART II

2. Prepare the December 31, 2013, shareholders' equity section (assume that 2013 net income was $270,000).

Contributed Capital

Preferred Stock (6%,$100 Par) $_________________

Additional Paid in Capital on Pref Stock _________________ $________________

Common Stock ($2.50 Par) $________________

Additional Paid in Cap. on Common Stock _________________ $________________

Additional Paid in Cap on Treasury Stock ________________

Additional Paid in Cap from Stock Dividend ________________

TOTAL CONTRIBUTED CAPITAL $_______________

REtained Earnings _______________

Accumulated other comprehensive income (loss)

Unrealized Decrease in value of avail for sale securities ________________

Total Contrib. Capital,retained earnings, and accum other compreh. income $_______________

(less) Treasury Stock _______________

Total Shareholder's Equity $______________

|

Average firm in the industry has total assets turnover ratio

: Adele Corp's sales last year were $315,000, and its year-end total assets were $355,000. The average firm in the industry has a total assets turnover ratio (TATO) of 2.4. The firm's new CFO believes the firms has excess assets that can be sold so as ..

|

|

What has happened to treasury rates over the past ten years

: Explain what this graph is showing. What has happened to Treasury rates over the past ten years? Are rates higher or lower than they were five years ago and ten years ago? How much have they changed?

|

|

Analyze the data for the dogs and the cats separately

: These data were collected using a telephone interview with pet owners in Mishawaka, Indiana. The animal shelter was run by the Humane Society of Saint Joseph County. The control group data were obtained by a random digit dialing telephone survey. ..

|

|

The dividends will grow at constant rate

: McPherson Enterprises is planning to pay a dividend of $2.25 per share at the end of the year (i.e., D1 = $2.25). The company is planning to pay the same dividend each of the following 2 years and will then increase the dividend to $3.00 for the subs..

|

|

Accumulated other comprehensive income

: Included in the December 31, 2012, Jacobi Company balance sheet was the following shareholders' equity section:

|

|

How would that affect its net income and held constant

: Garcia Industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. The industry average DSO is 27 days, based on a 365-day year. If the company changes its credit and collection policy sufficiently ..

|

|

Prepare a statement of revenues, expenditures

: Prepare the Balance Sheet for the Library Book Permanent Fund for the year ended December 31, 2012.

|

|

Black scholes option pricing model

: Given the model inputs below, what is the value of N(d1) as defined in the Black Scholes option pricing model? Current Stock Price: $100.00 Annual Standard Deviation: 25.00% Risk Free Rate (Annual): 3.00% Strike Price: $105.00 Maturity (Years): 0...

|

|

Invest in the international bond market

: Suppose you had $20 million U.S. to invest in the international bond market. Describe how you would invest your money and provide the rationale behind your chosen investments. Be sure to support your statements with arguments and examples.

|