Reference no: EM132907734

ACCT6004 Finance - Southern Cross University

QUESTION 1

(a) Give an example of a primary market transaction and a secondary market transaction and explain how they differ.

(b) An assumed company goal underlies most techniques in financial management. What is that goal? Give an example of a technique we have covered in the unit which uses this assumed goal.

QUESTION 2

A government bond has 3 years to maturity, a par value of $100 and a fixed semi-annual coupon rate of 5% p.a.

(a) What is the price of this bond in each of the following situations?

i. Investors require a YTM of 5% p.a. (For this part only, you do not have to show workings but you must briefly explain your answer.)

ii. Investors require a YTM of 8% p.a.

(b) State and explain the general bond valuation principle exemplified by your results in part (a).

QUESTION 3

(a) The table below includes information ABC Ltd, X Ltd and a portfolio of ABC and X. Calculate the missing figures (labelled A, B, C, D and E) in the table below.

|

Month

|

ABC

|

X

|

Portfolio

|

|

Jan-20

|

1.4%

|

1.0%

|

1.1%

|

|

Feb-20

|

1.7%

|

5.0%

|

4.0%

|

|

Mar-20

|

-52.7%

|

40.0%

|

C

|

|

Apr-20

|

37.6%

|

1.0%

|

12.0%

|

|

May-20

|

20.4%

|

-3.0%

|

4.0%

|

|

Average return

|

A

|

8.8%

|

6.7%

|

|

Standard deviation

|

B

|

17.7%

|

D

|

|

Portfolio weight

|

30.0%

|

70.0%

|

100.0%

|

|

Beta

|

1.1

|

-0.4

|

E

|

(b) Explain the benefit of investing in the portfolio in (a), rather than one of the individual companies.

(c) Write a brief interpretation of the beta for ABC and the beta for X.

QUESTION 4

Chopper Manufacturing Ltd is considering whether the company should undertake Project X, which involves theproduction and distribution of an updated type of coffee grinder. The company has paid $100,000 for a feasibility analysis of the project, which has provided the following information.

Forecasts for Project X are sales of 100,000 units per year at a price of $80 each. Variable costs per grinder will be 70 per cent of revenue and the projectwill have a 4-year life.

Fixed costs for the project will be $0.6 million per year and Chopper will need to invest a total of $0.8 million in new manufacturing equipment to undertake the project. Annual depreciation of the equipment for tax purposes will be $0.2 million per year. At the end of the project life, the equipment is expected tobe sold for $0.1 million. To support Project X, working capital will need to be increased up front by $0.4 million but this investment is expected to be fully recovered in the last year of the project.

Chopper pays company income tax ata rate of 30 per cent and has other taxable income, which it can reduce with any loses from Project X and hence reduce its tax. The company has a WACC of 8%.

(a) You have been given the following spreadsheet showing incremental cash flows of the project. Identify and correct the errors in this analysis. (10 marks)

To do this, you can edit the table below with the corrections. If you prefer, you can copy it into a spreadsheet, correct it and then paste it back into this document.

|

Figures in $millions

|

|

|

|

|

|

|

Year

|

0

|

1

|

2

|

3

|

4

|

|

Revenue

|

|

80

|

80

|

80

|

80

|

|

Variable costs

|

|

-5.6

|

-5.6

|

-5.6

|

-5.6

|

|

Feasibility analysis

|

-0.1

|

|

|

|

|

|

Fixed costs

|

-0.6

|

-0.6

|

-0.6

|

-0.6

|

|

|

Depreciation

|

|

-0.2

|

-0.2

|

-0.2

|

-0.2

|

|

Profit before tax

|

-0.7

|

73.6

|

73.6

|

73.6

|

74.2

|

|

Tax

|

-0.21

|

22.08

|

22.08

|

22.08

|

22.26

|

|

Profit after tax

|

-0.49

|

51.52

|

51.52

|

51.52

|

51.94

|

|

Equipment cash flows

|

-0.8

|

|

|

|

0.1

|

|

Working capital cash flows

|

-0.4

|

|

|

|

|

|

Net cash flows

|

-1.69

|

51.52

|

51.52

|

51.52

|

52.04

|

|

|

|

|

|

|

|

Notes on equipment salvage:

|

|

|

|

|

|

Market value at salvage

|

0.1

|

|

|

|

|

|

Book value at salvage

|

0

|

|

|

|

|

|

Taxable gain (loss)

|

0.1

|

|

|

|

|

|

Tax on salvage

|

0.03

|

|

|

|

|

(b) What needs to be considered before using the company's WACC as the discount rate for this project and why?

(c) Assume the NPV of the project is $3.5 million. Should the company accept or reject the project? Briefly explain, including a comment on the expected impact on firm value

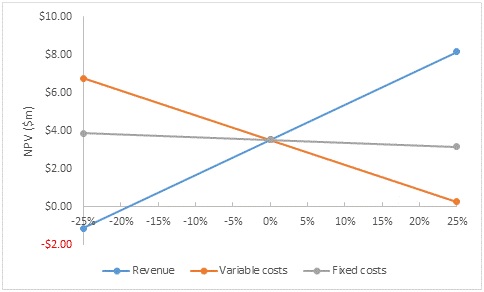

(d) The graph below shows the results of a sensitivity analysis of the project. Interpret these results, including managerial implications.

QUESTION 5

You have the following information on Pound Industries Ltd:

|

Debt/Assets Ratio

|

Bond Rating

|

After-tax cost of debt

|

WACC

|

|

0%

|

n/a

|

4.8%

|

12.00%

|

|

10

|

Aa

|

4.8

|

11.64

|

|

20

|

Aa

|

5.0

|

11.32

|

|

30

|

A

|

5.4

|

11.10

|

|

40

|

Baa

|

6.0

|

11.04

|

|

50

|

Ba

|

7.2

|

11.40

|

|

60

|

Caa

|

9.0

|

12.36

|

(a) What is the company's optimal capital structure and why?

(b) Use theories of capital structure to explain why Pound Industries' WACC would at first decrease and then increase as more debt is used in the capital structure.

QUESTION 6

Assume a perfect market world except for the following: tax on dividends is greater than the tax on capital gains in the hands of shareholders, there are transaction costs (including issuance costs), and information asymmetry exists between managers and shareholders. Given these assumptions, firms are behaving irrationally if they continue to pay dividends while also issuing new shares to raise funds for investment opportunities. Explain and critique this statement, referring where relevant to distribution policy theories in your discussion.

Attachment:- Finance.rar