Reference no: EM13178353

1. Marvin Corp, a publicly accountable entity sold new production equipment to Terrell Inc. Marvin Corp. has agreed to provide financing to Terrell Inc. in the form of a $450,000, 2% interest bearing note to be repaid in five years. At the time of the sale, prevailing market interest rates were 5%. What would be the carrying value of the note on the books of Marvin Corp. at the time of the transaction and one year after the sale? (round your answer to the nearest dollar).

a) $450,000 and $450,000

b) $391,552 and $411,130

c) $391,552 and $402,130

d) $391,552 and $380,974

2. Short Stack Manufacturing Corp. (SS) acquired a piece of equipment on January 1 costing $600,000. SS has adopted the diminishing balance method of depreciation using a rate of 25%. It is estimated that the asset will have a residual value of $100,000. What is the maximum depreciation to be claimed in the final year of claiming depreciation on this asset? Assume that the company has a December 31 year end.

a) $6,787

b) $26,697

c) $25,000

d) $100,000

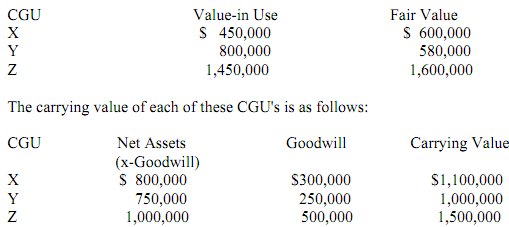

3. The Grass Roots Company Limited (GRC) has identified the following cash generating units (CGUs). With a downturn in the economy, GRC has determined that the CGUs should be tested for impairment. Management has determined the following:

The carrying value of each of these CGU's is as follows:

What would be the amount GRC would report if any for impairment?

a) $ 600,000

b) $1,020,000

c) $ 900,000

d) $ 700,000

4. Strait Corp. is preparing an insurance claim for a recent fire that destroyed their inventory. Existing accounting records indicated that in the current year, the company had sales of $6,000,000 and purchases of $4,800,000. The financial statements from the prior year reported an ending inventory of $1,600,000. Historically the company has realized a 32% mark up on cost. Based on this information, the estimated value of the physical inventory would be

a) $1,854,546

b) $1,600,000

c) $2,320,000

d) Can not be determined from the information provided

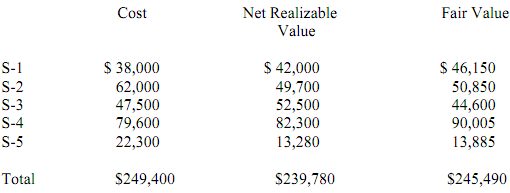

5. Ashton Limited is currently reviewing its inventory at year-end to determine whether a write-down is required for net realizable value. The major components of inventory are as follows:

How much of a write-down should W Company record if any to reflect the valuation of inventory in accordance with the Accounting Standards for Private Enterprise?

a) No write-down is required, cost is less than fair value

b) $22,465

c) $ 9,620

d) $21,320

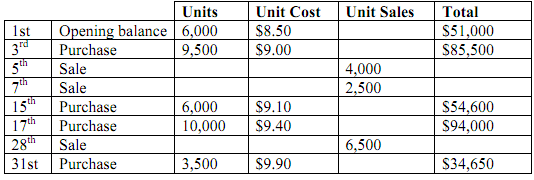

6. The Cramer Company Inc. had the following transactions during the month of January:

A count of the inventory on January 31st showed that 22,000 units were on hand. Cramer uses a periodic inventory system and measures the inventory value using the first-in first-out method. Unit selling price is $20.00

What amount will Cramer Company Inc. report as Cost of Sales for the month of January (round unit costs to four decimals)?

a) $319,750

b) $205,750

c) $183,250

d) $114,000

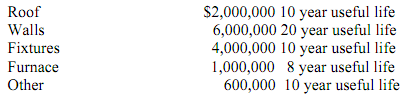

7. Stanley Inc., a publicly accountable entity, acquired a new building on January 1, 20x10. The following major components have been identified:

The company has adopted the straight line method of depreciation with all assets having a zero residual value. On December 31, 20x16 the roof is replaced at a cost of $3,000,000. What loss if any would the company report due to the roof replacement?

a) $800,000

b) $600,000

c) $ 0

d) $400,000

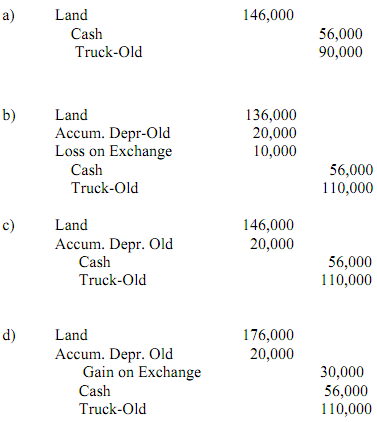

8. Simon Limited has arranged to exchange an under utilized truck for some land currently not being used by Garfunkel Corp. Simon has agreed to pay $56,000 in addition to providing the truck in the exchange. The land had recently been appraised at a fair value of $120,000 and the fair value of the truck is $80,000. The truck's original cost was $110,000 and had been depreciated $20,000. Since Simon has determined that the transaction has commercial substance, which of the following entries best reflects the entry Simon should be making to account for the exchange?

9. At the beginning of the year, Lynn Corp. (a publicly accountable entity) purchased equipment for a price of $3,400,000 to be repaid in 6 years. As an incentive, the vendor offered low interest financing at a rate of 1.5% per year when prevailing market interest rates were 4%. Matthews uses the diminishing balance method of depreciation with a rate of 30% for this type of equipment with an estimated residual value of $400,000. Based on this information what would be the total charge to the Matthews Corp. Statement of Income in the fourth year from the date the equipment was acquired.

a) $427,668

b) $389,414

c) $433,596

d) $430,575

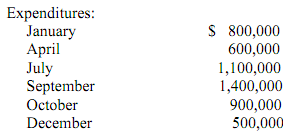

10. Pillow Corp. a publicly accountable entity is planning on building an extension to their existing factory. As a qualifying asset, activity on the project commenced in January 2011 and was completed in December of the same year Expenditures were incurred as follows (assume expenditures occurred at the beginning of the month)

To finance the project, the company borrowed $2,200,000 at a rate of 5.5% at the beginning of the year. Any other financing was to come from existing debt lines that included:

7.00% bank line of credit of $6,000,000

5.50% bank line of credit of $8,000,000

To account for this project the company

a) will capitalize interest on the asset specific borrowing.

b) will make an accounting policy choice to either capitalize the interest or expense the interest on the asset specific borrowing.

c) will capitalize $141,477.

d) will capitalize $170,922