Reference no: EM132242211

Denali Outfitters

In 1988, Steve Walker started a small mountaineering gear retail store in Seattle, which he called Denali Outfitters. Steve named it after the tallest peak in North America with a summit elevation of 20,310 feet. Located about five hours north of Anchorage, the peak has been referred to as Denali by the Koyukon people who inhabit the area around the mountain for centuries. In 1896, a gold prospector named it Mount McKinley in support of then-presidential candidate William McKinley, which remained the official name until 2015. The first verifiable ascent to Denali's summit was achieved on June 7, 1913, by four climbers who went by the South Summit. In 1951, Bradford Washburn pioneered the West Buttress route, considered to be the safest and easiest route, and therefore the most popular currently in use. Steve completed his ascent of the South Summit in 1986.

Thirty years later, Steve had opened nine additional retail stores in the Pacific Northwest. The retail stores were fully owned by Denali Outfitters and operated as profit centers. Their main product line was a variety of in-house designed high-tech jackets that were fully waterproof while being breathable and lightweight. These versatile jackets sold throughout the entire year and their demand was not materially affected by time of the year. Annual jacket revenues for each store were of similar size and amounted to roughly $2,750,000 per store. Several years ago, Denali Outfitters decided to focus on its core competencies of design and retail and to outsource production to a textile contract manufacturer. Denali jackets sold at an average retail price of $378, which represented a mark-up of 35% above what Denali paid the manufacturer

Being a profit center, each store made its own inventory decisions. Stores were supplied directly from the contract manufacturer by truck. The manufacturer as part of a long-term contract that not only stipulated a variable unit sourcing cost, but also transportation characteristics offered the following transportation package. A shipment of up to a full truckload, which was more than 2,500 jackets, was charged a flat fee of $3,500 and was guaranteed to reach the store in two weeks after order placement. While the stores were located at slightly different distances from the manufacturer, a uniform average flat fee was agreed upon to offer uniform service to each store. Typically, stores placed roughly three orders per year, each of about 2,500 jackets.

Looking into the future, Steve was contemplating two new initiatives for Denali Outfitters. The first one was a rather radical change to current operations yet it sounded attractive to Steve as he pondered its financial and personal implications. Steve had noticed that the growth in internet sales had begun to outpace the growth in sales from his retail stores. Although he had done no advertising outside of the Pacific Northwest, he saw that customers who had moved to other parts of the country remained loyal and apparently spread word of the store to friends and family elsewhere. With the current structure of his supply chain, it was difficult to fulfill the internet orders from the ten store’s stockrooms. The plan would be to drastically reduce the stockrooms in the ten stores and open a single distribution center to supply the stores and fulfill internet orders. The freed-up space in the stores would allow expansion of the sales floor and provide space for demonstrations and various activities such as climbing and rappelling walls. Steve felt that consolidated inventory management should provide considerable savings over the current setup

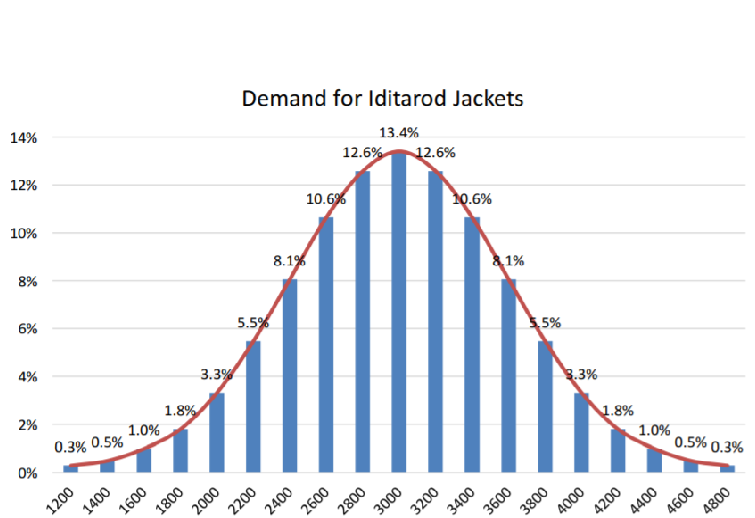

The second initiative involved a one-time offering of a special line of down winter coats branded for the Iditarod Trail Sled Dog Race, known as the Last Great Race on Earth®. Not only would these Iditarod coats serve as a good marketing booster but they also would command a higher retail price of $480. There were two downsides, however. To be able to offer the same unit cost for this Iditarod edition as the other jackets, the manufacturer needed sufficient time so as to level its production and therefore demanded that Denali Outfitters place its complete order six months in advance. The difficulty was that there was considerable uncertainty to the season’s sales for the special line. Sales would be dependent on many factors, including weather, location, taste, and competitive offerings. Marketing research forecasted that total demand across all stores would be normally distributed with a mean of 3,000 and a forecast error (standard deviation) of 600, which is depicted on the graph below. The higher margin only applied before the race. Any stock left-over after the race was over would be sold at deep discount at $228.

Before plunging forward with his decision, Steve has asked you to complete a supply chain and inventory analysis. Specifically, he’s looking for answers to the following questions.

1. What is the total annual inventory cost in the current supply chain?

2. What order size would you recommend for a store in the current supply network? Would switching to this order size save money? If yes, how much?

3. When should a store place its order, assuming demand is steady and predictable?

4. In reality, demand fluctuates from week to week. In fact, past weekly demand at each store exhibited a standard deviation of about 40 jackets. How should the ordering policy be adjusted if each store wants its stock-out probability not to exceed 5%?

5. What are the supply chain inventory savings from adopting the single distribution center initiative? For the financial evaluation, assume that Denali has an annual cost of capital of 25%. 6. What order size would you recommend for the Iditarod jacket if the single distribution center structure were adopted?