Reference no: EM13374951

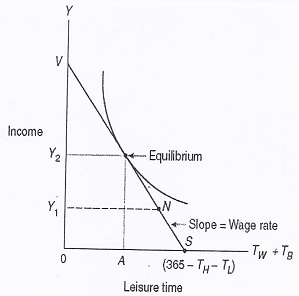

1. Refer to the above figure. Suppose that you have 365 days per year and could earn $200 per day for each day you worked. Also suppose that you are 10 days ill per year (TL=10) and you spend approximately 5 days per year on health enhancing activities (TH=5). Thus the time that you have available for work and leisure is 365- Tn-Ti.. Draw your budget line with respect to your leisure time and income. Show the values on the intercepts.

B) Suppose that you choose to work 200 days per year. Draw the appropriate indifference curve that is tangent to the budget line. What is your equilibrium yearly income? What is your equilibrium leisure choice (i.e., how many days)? Show on the graph.

C) Suppose that you increase the time that you spend on health producing activities, TH, from 5 days to 10 days. Correspondingly, suppose that the number of days lost due to illness, TL , has been reduced to 2 days. Also suppose that the improvement in your health status also increased your productivity at work, resulting in a higher wage, $210 per day. Draw the initial budget line and the new budget line on the same graph. Show how your equilibrium level of income and labor-leisure choice will change (i.e., draw the appropriate indifference curves).

2. Consider a consumer with a medical bill of $1,000. He has a $200 deductible and a 20 percent coinsurance rate. What is his "out-of-pocket" liability for this bill?

3. The probability of the insurable event is 15%, and the insurer's loading cost is $200. Then, in a competitive insurance market, how much will it cost to purchase a $2,000 of insurance coverage (i.e., what is the competitive premium)?

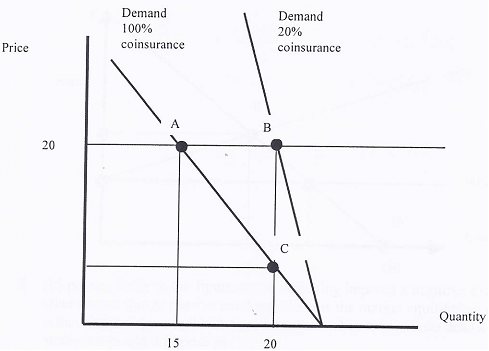

4. Refer to the figure above. Assume that the price of health care is $20.

A) How many units of health care would be consumed assuming that there is no health insurance?

B) How many units of health care would be consumed if the patient had health insurance (20% coinsurance)?

C) Calculate the deadweight loss due to health insurance.

5. Explain asymmetric information, moral hazard, and adverse selection within the context of health care sector. Give examples.

6. Suppose that the Cleveland State University decides to offer a benefit that costs Cleveland State University $2 per hour but is worth $3 per hour to the employees. Draw labor demand and supply. What happens to total employment? Compare "wages + benefits paid by the employer" at the new equilibrium with the wages at the initial equilibrium.

7. Bill's gross pay per week is $600, and every week he purchases $50 worth of health insurance. Assume Bill's marginal tax rate is 20%. What is Bill's net pay (income after tax and insurance) when he buys his own health insurance? What is Bill's net pay (income after tax and insurance) when Bill's health insurance is purchased by his employer?

8. Refer to the figure above. Smoking imposes a negative externality on other people due to passive smoking. What is the market equilibrium quantity? What is the efficient quantity? If the government wishes to eliminate deadweight loss, how much tax should it impose per unit?