Reference no: EM13381019

1. Lois Inc. has a $1,000 par value bond outstanding that pays 10 percent annual interest. The current yield to maturity on such bonds in the market is 8%. Compute the price of the bonds for these maturity dates:

a. 30 years.

b. 15 years.

c. 1 year

2. You are called in as a financial analyst to appraise the bonds of Nellie's Jewelry Stores. The $1,000 par value bonds have a quoted annual coupon interest rate of 12%, which is paid semiannually. The yield to maturity on the bonds is 10% annual interest. There are 10 years to maturity.

a. Compute the price of the bonds based on a semiannual analysis.

b. With 5 years to maturity, if yield to maturity goes down to 6%, what will be the new price of the bonds?

3. Kenny Powers, a promising young baseball pitcher is killed in a plane crash. It was anticipated that he could have earned $1,000,000 a year for the next 10 years. The attorney for the plaintiff's estate argues that the lost income should be discounted back to the present at 5%. The lawyer for the defendant's insurance company argues for a discount rate of 10%. What is the difference between the present value of the settlement at 5% and 10%? (Compute each separately and then subtract the defendant's present value from the plaintiff's present value).

4. Compute both Ke and Kn under the following circumstances (your answers should be expressed as a percentage with at least two decimal places, example 2.34%) :

a. D1 = $3.80, P0 = $48, g = 4%, F = $2.20

b. D1 = $0.75, P0 = $30, g = 6%, F = $1.00

c. E1 (earnings at the end of period one) = $6, payout ratio equals 20%, P0 = $24, g = 5%, F = $1.75 (hint: payout ratio is the percentage of earnings paid out as dividends)

d. D0 (dividend at the beginning of the first period) = $2.50, growth rate for dividends and earnings (g) = 10%, P0 = $60, F = $1.50. (hint: you must first figure out how to use D0 and g to calculate D1 )

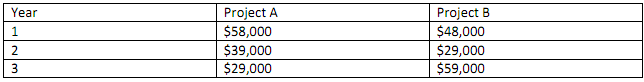

5. Bueller Bicycle Inc. is considering two investments, both of which cost $100,000. The cash flows are as follows.

a. Which of the two projects should be chosen based on the payback method (show calculations for each)

b. Assuming a 10% cost of capital, which of the two projects should be chosen based on the net present value method (Which project has the higher NPV)?

c. Should a firm normally have more confidence in answer a or answer b?

6. Assume a firm has earnings before depreciation and taxes of $800,000 and depreciation of $180,000.

a. If the firm is in a 40% tax bracket, compute its cash flow.

b. If it is in a 30% tax bracket, compute its cash flow.

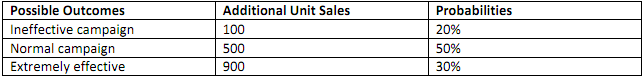

7. Ashley Inc. is evaluating a new advertising program that could increase furniture sales. Possible outcomes and probabilities of the outcomes are shown below. Compute the coefficient of variation.

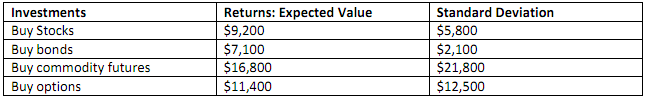

8. James is highly risk-averse (avoids risk) while Henry actually enjoys taking a risk.

a. Which one of the following four investments should James choose? Compute coefficients of variation to help you in your choice.

b. Which one of the four investments should Henry choose?