|

Users of Financial Statements

|

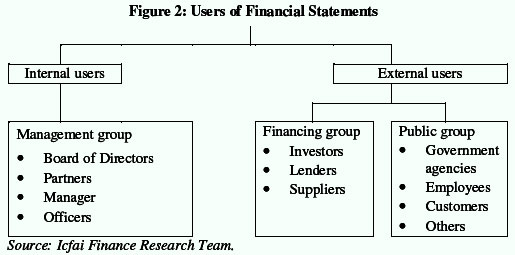

As stated earlier, financial statements are the windows to the health of the company. This information is useful not only to the internal people of the organization but also to the people external to the organization. The following figure gives you a clear idea about the users of Financial Statements:

Shareholder/Investors/Owners

The suppliers of the risk capital are called as owners in case of a sole proprietorship, partners in the case of a partnership concern, and shareholders in case of joint stock companies. The shareholders are the investors who provide capital or resources to an enterprise in exchange for a share in ownership of the enterprise. Because of the separation of the ownership from management in case of Joint Stock Companies, the financial statements are the means by which the shareholders become aware of how their funds are being put to use. The information provided in the financial statements helps them to arrive at various investment decisions such as, whether to invest further, or withdraw the existing investments, etc. Similarly, potential investors use the financial statements to arrive at investment decisions.

Management

In a company form of organization, the owners or the shareholders elect a group of people to manage the day-to-day affairs of the company. Since these managers are ultimately responsible for the financial performance, they periodically compile and interpret the financial statements. An analysis of the financial figures is essential for the smooth and efficient functioning of the enterprise.

Lenders

Banks, financial institutions and other lenders provide funds to the business entity. They would be willing to part with their money only if they are assured a periodical return in the form of interest and ultimate return of their principal. The financial statements reflect the profitability and long-term solvency of the business and provide the assurance which the lenders look out for.

Suppliers/Creditors

Suppliers of raw materials etc., to the company are interested in the short-term liquidity of the company. The inability of the business to pay-off short-term liabilities affects its credibility and credit rating. Commercial bankruptcy may lead to sickness or dissolution in extreme cases. The suppliers look for the short-term liquidity and solvency of the business for judging the credibility of the firm through the analysis of the statements. The financial statements help the creditors to ascertain the capacity of the organization to pay on time for the goods and services supplied.

Employees

Employees have vested interest in the continued and profitable operations of the organization in which they work. Financial statements can be used as important sources for obtaining information regarding the current and future profitability and solvency. Most of the incentive plans of large number of enterprises are directly related to the profitability of the business. This further magnifies the interest of the employees in the company's future profitability and health. Financial statements are used as important sources for obtaining information in this direction.

Customers

They comprise groups such as producers, wholesalers and retailers and final consumers. Legal obligations associated with guarantees, warranties and after sales service contracts tend to establish long-term relationship between the business and its customers. The financial statements may be used by the customers to draw inferences about the long-term viability of the firm.

Government and other Regulatory Agencies

Correct assessment of income tax, excise duty, etc., requires a close scrutiny of the financial statements of an organization especially to detect tax evasion, if any. Government plans and policies in respect of taxation, subsidies and incentives are guided by the requirements of the industries and also their past performance. Government as an overall guardian of public interest keeps a close watch on the various firms to detect profiteering and the creation of monopolies. A lot of information in this regard can be gathered by scrutinizing the financial statements of business enterprises.

National income accounting used in macroeconomic analysis derives its fundamental inputs from financial statements. The tax payable by the enterprises as well as the compilation of countrywide statistics is discerned using the financial statements.

Research

Scholars undertaking research into management science covering diverse facets of business practices look into the financial statements for the information eventually used for analysis. Such statements are of great value to persons searching for company specific information.

Others

Diverse persons such as academicians, researchers and analysts may approach business firms for information regarding the financial performance. To draw proper conclusions they would have to study the financial statements in depth. The public in general also examines the financial statements for employment opportunities, health of the concern in particular and economy as a whole.

Each interested party as listed above may have a different focus. For instance, an owner may be largely interested in the profitability of his firm so that he may be able to assess his own share in the assets. The managers may be primarily interested in various cost and control information pertaining to different departments and functions. The banks may be interested in assessing the working capital needs of the firm. Thus, no one set of accounts can ever meet the requirements of all the users. However, the balance sheet, Profit and Loss statement, Cash flow statements briefly discussed above, are by and large general purpose financial statements, which are of interest to everybody.

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Users of Financial Statements questions? Users of Financial Statements topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Users of Financial Statements related problems. We provide step by step Users of Financial Statements question's answers with 100% plagiarism free content. We prepare quality content and notes for Users of Financial Statements topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours