Return on Investment

Return on Investment ratio is the most widely used tool to measure company performance. Those who finance the company in the form of equity and debt measure the company's performance with this tool. This ratio links the profits and the investment required to generate the former. It also helps to assess a company's return relative to its capital investment risk, since riskier investments are expected to yield higher returns. This ratio is the most widely used ratio for managerial effectiveness, level of profitability, planning and control.

This ratio reflects the managerial skill, resourcefulness, ingenuity, and motivation of managers. It is also an important indicator of long-term financial strength of the company. The diverse perspective of various users of the financial statements has resulted in different versions on Return on Investment.

-

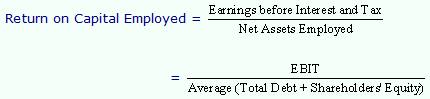

Return on Capital Employed (ROCE): Traditionally, capital employed has been considered as total long-term funding. This ratio assesses the return earned by both equity and debt. It indicates how well the firm utilizes its asset base.

Return = Net Profit + Interest on long-term debts + Provision for tax

Capital employed = Equity share capital + Reserves and surplus + Preference share capital + Debentures + Long-term loans - Miscellaneous expenses.

Or

Capital employed = Net total assets = Fixed assets + Current assets - Current liabilities.

This ratio measures the ability of the firm to reward providers of long-term funds. This ratio also helps to attract future providers of capital. This is one of the most important ratios used for measuring the overall efficiency of a firm. The primary objective of the business is to maximize its earnings; this ratio indicates the extent to which this primary objective of business is being achieved. This ratio is of great importance to the present and the prospective shareholders as well as the management of the company. It reveals how well the resources of the firm are being used; higher the ratio, better are the results.

-

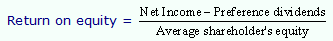

Return on Equity: Since from the point of view of equity shareholders, preferred stock has a fixed claim to the net assets of the company, this ratio is computed by dividing the income after tax less preference dividend by total shareholder's equity less preference stock.

This ratio focuses on the efficiency of the company in earning profits on behalf of its equity shareholders, by relating the profits to the total amount of equity shareholder's funds employed in the company. The two elements of the ratio are net profits and equity shareholder's funds. Equity Shareholder's funds include equity share capital, free reserves such as share premium, revenue reserve, capital reserve, retained earnings and surpluses less accumulated losses, if any. Net income is arrived at after deducting interest on long-term borrowing and income tax, because those will be the only profits available for shareholders.

The return on shareholders' investments should be compared with the return of other similar businesses in the same industry. The inter-firm comparison of this ratio helps in determining whether the investments in the firm are attractive or not as the investors would like to invest only is those companies where the returns are higher. Likewise, the trend ratios can also be calculated for a number of years to get an idea of the prosperity, growth or deterioration in the companies' profitability and efficiency.

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Return on Investment questions? Return on Investment topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Return on Investment related problems. We provide step by step Return on Investment question's answers with 100% plagiarism free content. We prepare quality content and notes for Return on Investment topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours