PRICE/Book Value RATIO

This ratio compares an investor's assessment of a company's wealth at a particular point of time with the company's reported financial position. This ratio is calculated by using the following formula

This ratio is useful to know how many times that the share is overvalued or undervalued in the market. If this ratio yields slightly in excess of 1, then the reported costs of net assets based on historical cost (reflected in the book value per share) can be said to approximate the market's perception of the company's earnings power (reflected in the Market price per share). If the market price substantially exceeds book value, then the market thinks historical cost disclosures are irrelevant for projecting future rate of returns. A ratio of less than one means the market considers the firm's assets as impaired though it is unrecognized by the financial reporting system.

Market price per share is available on any day from the major stock exchange portals. The book value per share can be calculated by assets approach method or liabilities approach method. Here we calculated book value per share based on assets approach.

For calculating the Price/Book value ratio, first we have to find out the book value per share. Following is the computation of book value of Infosys.

(Rs. in crore)

|

|

As on 31-3-2007

|

As on 31-3- 2006

|

|

Fixed Assets (A)

|

3,107

|

2,133

|

|

Investments

|

839

|

876

|

|

Deferred Tax Assets

|

79

|

56

|

|

Current Assets, Loans And Advances

|

8,961

|

6,049

|

|

|

12,986

|

9,114

|

|

Liabilities (B)

|

|

|

|

Secured and Unsecured Loans

|

-

|

-

|

|

Current Liabilities and Provisions

|

1824

|

2,217

|

|

|

|

2,217

|

|

Preference Shareholders Funds (C)

|

|

|

|

Preference Share Capital

|

-

|

-

|

|

Dividends due to Preference Shareholders

|

-

|

-

|

|

|

|

-

|

|

Equity Shareholders Funds

(D = A - B - C)

|

11,162

|

6,897

|

|

No. of Equity Shares for Basic EPS (E)**

|

57,12,09,862

|

27,55,54,980

|

|

Book Value Per Share (D) ¸ (E)

|

195.41

|

250.29

|

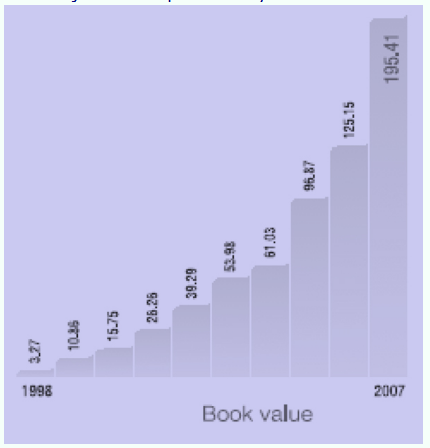

Book value per share of Infosys is showing an increasing trend. It is a positive sign for the company as well as to shareholders. This ratio is only useful to shareholders to know how much amount they will get if the company is going for liquidation. Generally, analysts do not use book value per share because this value is based on the historical cost.

Price/book value Ratio of Infosys Technologies Ltd. for the years 2006 and 2005 is as follows:

|

|

2006-07

|

2005-06

|

|

Market Price as on 31st March *(Rs.) (A)

|

2,018

|

2,981

|

|

Book Value Per Share (Rs.) (B)

|

195.41

|

250.29

|

|

Price/Book Value Ratio (A) ¸ (B)

|

10.33

|

11.91

|

Market price is nearly 11 times more than the book value per share. It is a positive sign. Shareholders' equity is 11 times overvalued in the open market.

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Price/Book Value Ratio questions? Price/Book Value Ratio topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Price/Book Value Ratio related problems. We provide step by step Price/Book Value Ratio question's answers with 100% plagiarism free content. We prepare quality content and notes for Price/Book Value Ratio topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours