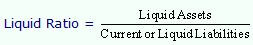

Liquid or Acid-test or Quick Ratio

This ratio is a supplementary ratio to give double assurance as to the soundness of the current financial position of a business. This ratio is calculated by dividing the quick asset by current liabilities. It represents the number of times current liabilities are covered by quick assets or the number of rupees of liquid assets relative to total current liabilities. It indicates the firm's ability to pay its current liabilities out of its most liquid assets. Liquid assets are the assets which can be converted into cash immediately without any loss and includes cash, bank balance, bills receivables, sundry debtors, short-term investments. In other words,

Quick Assets = Current Asset - Inventory and Prepaid Expenses

The reason for exclusion of inventories and prepaid expenses in the above computation is that they normally take time to realize cash. Inventory may be slow moving or possibly obsolete or may be pledged to creditors, hence the inclusion of these in the liquid assets seem meaningless. Some of the accountants prefer the term Liquid Liabilities instead of current liabilities. Liquid liabilities are all current liabilities excluding bank overdraft. The formula to calculate this ratio is:

A quick ratio of 1:1 is considered fairly good and ideal. It is considered wise to maintain the liquid asset equal to liquid liabilities at all times. However, a comparison of the firm's past quick ratio, a comparison with major competitors and industry average would be more meaningful.

Considering the above data of Tata Steel Ltd. Calculate the Quick Ratio of the company.

Quick Ratio of Tata Steel Ltd. for the years 2006-07 and 2005-06 are given below (The annual report can be accessed in company site):

(Rs. in crore)

|

|

2006-07

|

2005-06

|

|

Sundry debtors

|

631.63

|

539.40

|

|

Cash and bank balances

|

7681.35

|

288.39

|

|

Interest accrued on investments

|

0.20

|

0.20

|

|

Loans and advances

|

3055.73

|

1234.86

|

|

Quick Assets (A)

|

11368.91

|

2062.85

|

|

Current Liabilities

|

3523.20

|

2835.99

|

|

Provisions

|

1930.46

|

972.73

|

|

Current Liabilities (B)

|

5453.65

|

3808.72

|

|

Quick Ratio (A) ¸ (B)

|

2.08

|

0.54

|

Employee Privacy Issues

-

The company's quick ratio has increased considerably. The ideal quick ratio is 1:1. As against its last year position, which was precarious, as company's liquidity position is not sufficient to meet its short-term obligations, in 2006-07 it has improved.

When analysts view the liquidity of the firm from an extremely conservative point of view they use absolute liquid ratio.

In this ratio, absolutely liquid assets are considered and includes only cash in hand, cash at bank and short-term marketable securities. Bills receivable and inventories are excluded because there is a doubt of its reliability in cash at a time. This ratio is calculated by following formula:

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Liquid or Acid-test or Quick Ratio questions? Liquid or Acid-test or Quick Ratio topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Liquid or Acid-test or Quick Ratio related problems. We provide step by step Liquid or Acid-test or Quick Ratio question's answers with 100% plagiarism free content. We prepare quality content and notes for Liquid or Acid-test or Quick Ratio topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours