Hedging Instruments

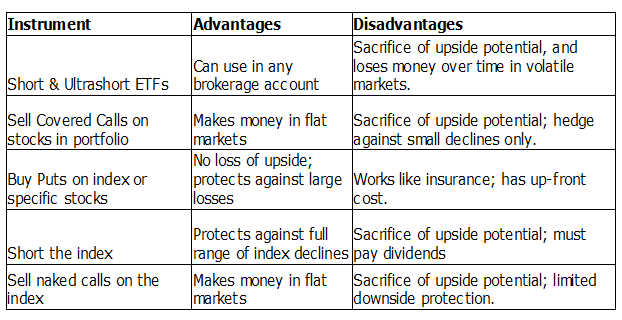

There are different type of market instruments which can be employed to hedge the portfolio, the five variations are shown below.

Buying Short and Ultrashort ETFs

It is the first option that is most easily accessible to all capitalists. If financial expert are interested in purchasing stocks, they can buy Ultrashort or Short ETFs which is affirmed on dozens of market indexes. If the underlying index go up by 2% in the day, the related Short ETF will come down by about 2% and an Ultrashort ETF will decrease by 4% and vice verse.

Ultrashort and Short ETFs along with concerned leveraged ETFs have the fatal defect which forms them impertinent for long term employ. When the inherent index is volatile, these instruments lose wealth over time due to the geometric nature of compounding.

Selling Covered Calls

Selling Covered Calls on the stocks in the portfolio expects the most basic level of options permission from the agent. Given the very low risk of this options strategy, however, financial expert do not have to have extensive knowledge or experience with options to obtain permission to trade (or "write") covered calls.

There are two introductory welfare. First is, covered calls are tools which are moderately usable to most stock market capitalist with only the hour or the work which is anticipated to experience low level alternatives trading permission from the agent. Too soon options trading experience is not likely to be requisite and this is the beneficial way to obtain options trading experience if the agent expects it in order to start employing more convoluted alternatives strategies.

Second, financial expert only anticipate the market to not go up in order to be improve by trading covered calls. Most preferably, the market will be comparatively stable, and financial expert will not lose wealth on the stocks, but financial expert will make benefits on the calls financial expert compose.

The weaknesses of covered calls are that the downside trade protection is somewhat confined, by and large to downslopes of 5-10%, while financial expert cut down all the potential difference of upper side profits in the rudimentary stock.

Trading covered calls is an uncomplete hedging strategy extending no protection against prominent market downslopes, and thus employ it only in alliance with some other strategies.

Buying Puts

Buying Puts is is similar to the purchasing insurance on the portfolio. If financial expert want to protect against large downslopes in peculiar stocks, financial expert could buy puts allowing financial expert to trade those stocks for the fixed cost at the later date. If financial expert want to protect against the large downslope of an index, financial expert could purchase puts on that index which will adjudicate for immediate payment if the index comes down below the strike cost or if financial expert could purchase the ETF at the future dispirited cost and trade the ETF at the strike cost for the profit, setting off losses to another place in the portfolio.

The primary benefits of purchasing puts are that the financial expert extend all over protection against downslopes past the strike cost of the opting and there is no deprivation of upper side capableness in the portfolio. Puts are one-sided stakes. Marked by correspondence to the most one-sided bets, the financial expert get in at the cost. The insurance policy puts extend anticipates compensating the premium and that premium must be reincarnated when the financial expert accomplish their termination date.

Another benefit of buying puts is that it is only moderately more unmanageable to obtain alternatives permission admitting financial expert to buy puts than it is to obtain permission to trade covered calls. The schemes which follow both could entail in a theoretical manner unlimited losses and acquiring permission from the agent to employ them is more hard in a corresponding manner.

Shorting the Index

Shorting the Index is the classical mode to hedge. When the index movements up, financial expert lose wealth on the short perspective, but the stock portfolio should be acclivitous as well, isolating financial expert from the market movement. When the index downslopes, the gains in the short position beginning the anticipated losses to another place in the portfolio.

The primary welfare of shorting the index is easiness. Not like alternatives strategies, financial expert do not anticipate to renew at regular time intervals the positions as alternatives choke or to conform the vulnerability as the sensibility of the options alters with market movements. The primary weaknesses are that financial expert will anticipate to compensate any dividends pronounced on the security financial expert are short-changing and financial expert by and large do not bring in interest on the cash retained in the margin account to cover the short position. If the short movements against financial expert, financial expert might even have to move up with more cash to deal with the short position or begin compensating margin interest. This is in contrast to trading/writing calls, where financial expert are able to bring in interest (or even re-invest the cash received.)

Selling (Writing) Calls on the Index

Selling (Writing) Calls on the Index (or index ETF) is the hybrid among tradinsensibilityg covered calls and shorting the index. Unlike shorting, the balance which financial expert anticipate to maintain to cover the position will by and large accrue interest and financial expert will also try to bring in wealth on the premiums for which the calls were composed if the index continues comparatively flat.

This may have the disfavor that there is little security counterbalanced to downslopes in the index below the strike cost of the call financial expert dealt. Despite anything to the contrary, financial expert could trade calls with strike prices substantially under the current level of the index, in spite of the fact that this arrives at the cost of more modest gains when the index is flat. Any of various alternatives strategy is to go forward trading more calls in a dynamic manner as the index downslopes, which brings so foresightful as the market does not downslope so responsively that it is hard to ascertain call buyers at fairish prices.