Fixed Interest Coverage Ratio

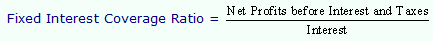

This ratio measures the cover or safeguard that exists for the lenders of debt. This ratio reveals the debt servicing capacity of the firm. Lenders check this ratio before deciding on lending the money to the firm. Hence this is an important ratio from the lenders' point of view. It measures the adequacy of profits to cover the interest i.e., whether the business earns sufficient profits so as to pay the interest charges periodically. The formula is:

The rule - the higher the ratio, better for lenders and more secured their periodical interest income. If the firm has good coverage of interest obligation, it can be said that the firm will be able to refinance its principal as and when it becomes due. A relatively high, stable coverage ratio indicates a good record. This ratio is often used by managers to decide upon the amount of debt obligations to be raised. This practice of issue of debt obligations at an interest rate less than the return from use of these funds is called 'trading on equity' or 'leverage'. This ratio identifies the extent to which the company will be able to safely 'trade on equity' since the higher the interest payable, the higher the risk that the company will fail to meet its interest obligations.

Since there is no Debt component in Infosys Capital structure. There is no interest component in Income statement and hence computation of interest coverage ration is meaningless.

For the purpose of students, Calculation of Interest Coverage Ratio of Tata Steel Ltd. for the years 2006-07 and 2005-06 is given (The Annual report can be accessed from the company site):

(Rs. in crore)

|

|

2006-07

|

2005-06

|

|

Profit before tax

|

6261.65

|

5239.96

|

|

Add back Interest

|

173.90

|

124.51

|

|

Profit before Interest and Tax (A)

|

6435.55

|

5364.47

|

|

Interest (B)

|

173.90

|

124.51

|

|

Interest Coverage ratio (A) ¸ (B)

|

37.00

|

43.08

|

Interest coverage ratio decreased to 37.00 during the 2006-07 as against the earlier coverage of 43.08. This indicates an increase in insecurity among creditors. A detailed study of Management Discussion & Analysis reveals that net interest charges increased by 40% to Rs.173.90 crore as compared to Rs.124.51 crore in the previous year, mainly due to increase in interest on Forex loans, swap charges for hedging currency and interest rate risks and higher working capital loans.

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Fixed Interest Coverage Ratio questions? Fixed Interest Coverage Ratio topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Fixed Interest Coverage Ratio related problems. We provide step by step Fixed Interest Coverage Ratio question's answers with 100% plagiarism free content. We prepare quality content and notes for Fixed Interest Coverage Ratio topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours