Earnings Per Share

The EPS is a good measure of the profitability. The EPS when compared with the EPS of similar companies, gives a view of the comparative earnings or earnings power of a firm. EPS when calculated for a number of years indicates whether earning power of the company has increased over the years or not. It also helps in calculating market price of the share.

Earnings per share are a small variation of return on equity capital. As per AS-20, dealing with earnings per share should be shown as basic earnings per share and diluted earnings per share.

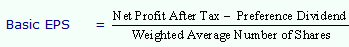

Basic earninsg per share is calculated by dividing the net profit after the taxes and preference dividend by the Weighted Average number of equity shares outstanding. The numerator represents the total amount of earnings available to equity shareholders after all deductions. Thus,

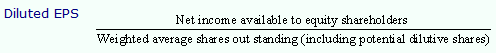

Diluted Earning per share is calculated by dividing the net profit after taxes and preference dividend by the weighted average number of shares. This is used when there are potential equity shares in the capital structure of the organization. A potential equity share is a financial instrument or other contract that entitles, or may entitle, its holder to equity shares.

In practice, most companies also compute EPS based on the normal or maintainable profits. This is referred to as Headline profit. The numerator is the profit derived from the ongoing activities of the business prior to charging such exceptional or one-off expenses and after all other deductions.

Calculation of EPS of Infosys Technologies Limited for the years 2006-07 to 2005-06 is as follows:

|

|

2006-07

|

2005-06

|

|

Net Profit After Tax and before Exceptional Item

(Rs. in crore) (A)

|

3,777

|

2,421

|

|

Net Profit After Tax and Exceptional Item

(Rs. in crore) (B)

|

3,783

|

2,421

|

|

No. of Equity shares for Basic EPS (C)

|

55,68,52,339

|

54,59,89,022

|

|

No. of Equity shares for Diluted EPS (D)

|

56,93,42,694

|

56,16,56,620

|

|

Basic EPS (before exceptional items) (Rs.) (A) ¸ (C)

|

67.83

|

44.34

|

|

Basic EPS (after exceptional items) (Rs.) (B) ¸ (C)

|

67.93

|

44.34

|

|

Diluted EPS (before exceptional items) (Rs.) (A) ¸ (D)

|

66.34

|

43.10

|

|

Basic EPS (after exceptional items) (Rs.) (B) ¸ (D)

|

66.44

|

43.10

|

In determining earnings per share, the company considers the net profit after tax and includes the post-tax effect of any extraordinary/exceptional item. The number of shares used in computing basic earnings per share is the weighted average number of shares outstanding during the period. The number of shares used in computing diluted earnings per share comprises the weighted average shares considered for deriving basic earnings per share, and also the weighted average number of equity shares that could have been issued on the conversion of all dilutive potential equity shares. The diluted potential equity shares are adjusted for the proceeds receivable, had the shares been actually issued at fair value i.e., the average market value of the outstanding shares.

|

EPS is the most widely available and commonly used performance statistical ratio in all publicly traded companies. It is used by investors to measure the operating performance and for valuation purpose either individually or together with market prices. It is now a standard practice to give EPS information in the published statements and hence is readily available for analysts. Analysts are required to exercise caution when comparing the EPS of one company with another since it may be misleading when two companies, which are identical in all respects except the number of shares issued, are compared. Similarly when trend analysis is undertaken using this ratio, the analysis may be misleading since any bonus issue would affect this ratio.

|

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Earnings Per Share questions? Earnings Per Share topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Earnings Per Share related problems. We provide step by step Earnings Per Share question's answers with 100% plagiarism free content. We prepare quality content and notes for Earnings Per Share topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours