Debtors or Receivable Turnover Ratio

A business concern may sell goods on cash as well as on credit. Credit is one of the important elements of sales promotion. Following a liberal credit policy can increase the volume of sales. But the effect of a liberal credit policy may result in tying up substantial funds of a firm in the form of trade debtors. Trade debtors are expected to be converted into cash within a short period and are included in current assets. Thus, the liquidity position of a concern to pay its short-term obligations in time depends upon the quality of its trade debtors.

-

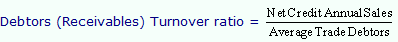

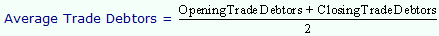

Debtors turnover ratio indicates the velocity of debt collection of firm. In other words, it indicates the number of times average debtors (Receivables) are turned over during a year.

Trade Debtors = Sundry Debtors + Bills Receivables and Accounts Receivables

-

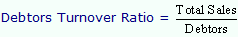

When the information about opening and closing balances of trade debtors and credit sales is not available, then the debtors turnover ratio will be calculated as,

Generally, the higher the value of debtors turnover the more efficient is the management of debtors/sales or more liquid are the debtors. Similarly, low debtors turnover implies inefficient management of debtors/sales and less liquid debtors. But a very high debtors turnover ratio may imply a firms inability due to lack of resources to sell on credit thereby losing sales and profits. There is no rule of thumb for interpretation of the ratio. This ratio should be compared with ratios of other firms doing similar business and a trend may also be found to make a better interpretation of the ratio.

Debtors Turnover Ratio of Tata Steel for the years 2006-07 and 2005-06 is given below:

|

|

2006-07

|

2005-06

|

|

Net Sales (Rs. in crore) (A)

|

17552.02

|

15215.50

|

|

Average Debtors (Rs. in crore) (B)

|

631.63

|

539.40

|

|

Debtors Turnover Ratio (A) ¸ (B)

|

27.07 of times

|

28.20

|

During the year 2006-07, the company's Debtors turnover ratio is increased, which indicates that the efficiency in the management of debtors is increased compared to the previous year.

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Debtors or Receivable Turnover Ratio questions? Debtors or Receivable Turnover Ratio topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Debtors or Receivable Turnover Ratio related problems. We provide step by step Debtors or Receivable Turnover Ratio question's answers with 100% plagiarism free content. We prepare quality content and notes for Debtors or Receivable Turnover Ratio topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours