Debt-Equity Ratio

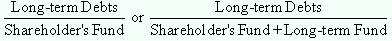

This ratio determines the soundness of the long-term financial policies of the company and also measures the relative investment proportions of outsider's fund and shareholder's fund in the company. It is also known as "External-Internal" equity ratio. It is calculated by the following formula:

The ideal ratio is 1:2 (i.e., 0.5) in first formula, and 2:3 (i.e., 0.67) in second formula. A low ratio is favorable from the creditor's point of view because it provides safety to creditors. But the same low ratio is unfavorable from the shareholder's point of view because he has to forgo the higher returns, if the outsider fund is utilized for acquiring fixed assets.

Long-term debts include debentures. Shareholders' fund includes share capital (equity share capital and preference share capital), profit and loss account, capital reserves, reserves for contingencies, sinking fund, fund for redemption of debentures less fictitious assets like preliminary expenses, discount on issue of shares, debentures, etc. However, it may be noted that preference shares, which are redeemable within 12 years, are taken as debt.

A high debt-equity ratio connotes high degree of leverage, which implies substantial interest charges, and substantial exposure to interest rate movements. A low proportion of debt indicates a conservative capital structure. Since most Software Companies in India are knowledge based with strong entrepreneurial roots, they rely primarily on equity financing and are conservatively structured.

Providers of finance often impose restrictions on companies to further borrow through 'debt covenants', which are expressed in terms of certain ratio measurements. In the event of breach, the provider may withdraw his finance and hence the debt-equity ratio is a critical measure which every company wants to present in a positive light.

Debt to Equity Ratio of Tata Steel Ltd. for the years 2006-07 and 2005-06 is given below:

|

|

2006-07

|

2005-06

|

|

Debt (Rs. in crore) (B)

|

9,645.33

|

2,516.15

|

|

Equity or Shareholders Funds

(Rs. in crore) (A)

|

13,893.62

|

9,502.03

|

|

Debt-to-Equity Ratio (B) ¸ (A)

|

0.69

|

0.26

|

Ideal ratio of debt-to-equity is 0.5. The company's ratio was 0.26 in 2005-06. It has increased to 0.69 in 2006-07. The Management Discussion and Analysis section clearly spells out that the Secured and unsecured loans increased by Rs.7,129.18 crore from Rs.2,516.15 crore as on 31st March, 2006 to Rs.9,645.33 crore as on 31st March, 2007 due to new syndicate foreign currency loans drawn for funding the acquisition of Corus.

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Debt-Equity Ratio questions? Debt-Equity Ratio topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Debt-Equity Ratio related problems. We provide step by step Debt-Equity Ratio question's answers with 100% plagiarism free content. We prepare quality content and notes for Debt-Equity Ratio topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours