Corporate Income Tax

In most economies, corporate profits constitute an important source of income and hence inequality. This tax has significant effects- on investment, savings and consumption. We will analyse the effect of profit tax on the pricing and output decisions of managers, The impact of such a tax depends on the objectives of managers as demonstrated here.

Profit Maximisation and Profit Tax

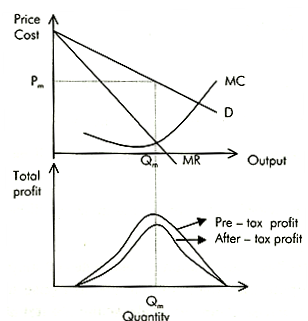

The profit maximising price and quantity for a monopoly are shown in Fig. It also shows the profit earned at various output rates. Note that profit increases till the output rate Qm and declines at higher output rates.

Now assume that a proportional tax of T per cent is levied on each rupee of profit. Total profits reduce by T per cent at each output rate due to this tax. The firm maximises after-tax profit by producing Qm units as before. Because the profit maximising quantity is same, the price set by the firm for the product will not change. It means that in the short run, the entire tax is paid by the firm in the form of reduced profits.

However, in the long run profit tax will reduce the net return on investment. This means that less investment will take place and hence the amount of capital in an industry will be reduced. This will increase the productive capacity slowly than if the tax had not been imposed. Thus, because quantity supplied will be less, in the long run prices are likely to be higher because of the tax on profit.

ExpertsMind.com - Corporate Income Tax Assignment Help, Corporate Income Tax Homework Help, Corporate Income Tax Assignment Tutors, Corporate Income Tax Solutions, Corporate Income Tax Answers, Business Decisions Assignment Tutors