Capital Gearing Ratio

This is the most commonly used measure which quantifies the relationship between fixed return bearing debt-to-equity. It quantifies the relationship between long-term sources of finance bearing fixed costs (loans, debentures, bonds and preference shares) to equity (bearing variable cost).

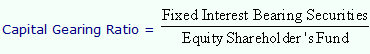

The formula is

Fixed interest-bearing securities include preference share capital, debentures and long-term loans, which carry fixed rate of dividend and interest.

The higher this ratio the more vulnerable the company is perceived to be since there is high fixed commitment on its profits before equity interests can be satisfied. The standard ratio is 1. If the ratio is 1, then the firm is said to be evenly geared. If the ratio is more than 1 then the firm is highly geared i.e., major portion of funding is in the form of fixed interest-bearing securities. If the ratio is less than 1,

then the firm is low geared.

Following is the extract taken from the annual report of Tata Steel Limited. Calculate Capital Gearing Ratio.

"The company's secured loans includes fixed interest debentures of Rs.2,135.22 crore as on 31.03.06 as against Rs.2,342.68 crore in the previous year. Shareholders' fund for the same periods is Rs.9,502.03 crore and Rs.6,845.10 crore respectively".

Capital Gearing Ratio of Tata Steel for the years 2006-07 and 2005-06 is given below:

|

|

2006-07

|

2005-06

|

|

Fixed Bearing Securities (Rs. in crore) (A)

|

5885.89

|

2,381.13

|

|

Shareholder's fund (Rs. in crore) (B)

|

13,893.62

|

9,502.03

|

|

Capital Gearing Ratio (A) ¸ (B)

|

0.42

|

0.25

|

Company's capital gearing ratio is increased from 0.25 in 2005-06 to 0.42 in 2006-07. It indicates that the company has increased its fixed bearing interest securities. Ratios like debt-equity ratio, and capital gearing ratio indicate that the company is depending more on their internal resources than outside resources.

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Capital Gearing Ratio questions? Capital Gearing Ratio topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Capital Gearing Ratio related problems. We provide step by step Capital Gearing Ratio question's answers with 100% plagiarism free content. We prepare quality content and notes for Capital Gearing Ratio topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours