Average Collection Period Ratio

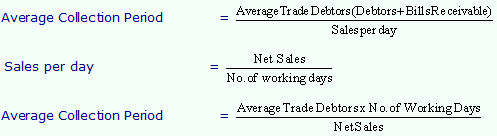

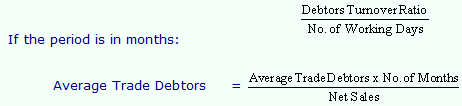

This ratio represents the average number of days for which a firm has to wait before its receivables are converted into cash.

Or

The average collection period ratio represents the average number of days for which a firm has to wait before its receivables are converted into cash. It measures the quality of debtors. Generally, the shorter the average collection period the better is the quality of debtors as a short collection period implies quick payment by debtors. Similarly, a higher collection period implies inefficient collection performance, which in turn adversely affects the liquidity or short-term paying capacity of a firm out of its current liabilities. Moreover, longer the average collection period, larger are the chances of bad debts. But a very short collection period may imply the firm's conservative policy to sell on credit or its inability to allow credit to its customers due to lack of resources and thereby losing sales and profits.

Managers and analysts compare average collection period with the company's credit terms to determine how effectively the company manages its receivables. For example, if the credit period is 30 days, then the average collection period should be 30 days. However, if this collection period is more than 30 days, it indicates collection problem. During this time period of 30 days, the company's resources are tied up i.e., low liquidity since it amounts to free credit out of the company's own resources. For a better understanding of the company's performance in receivables, a comparison over several years is to be made. For an internal and external analysis the average collection period of a particular firm should be compared with industry average and other firms in the industry.

Taking the data given in the above illustration, calculate average collection period ratio.

Average Collection Period Ratio of Tata Steel for the years 2006-07 and 2005-06 is given below:

|

|

2006-07

|

2005-06

|

|

No. of days in a year (A)

|

365

|

365

|

|

Debtors Turnover Ratio (B)

|

27.79

|

28.06

|

|

Average Collection Period Ratio (A) ¸ (B)

|

12 days

|

13 days

|

Average collection period is decreased from 13 days to 12 days. It means the company's performance in the collections is increased. Debtors are more liquid now compared to the previous year.

Email based Accounting assignment help - homework help at Expertsmind

Are you searching Accounting expert for help with Average Collection Period Ratio questions? Average Collection Period Ratio topic is not easier to learn without external help? We at www.expertsmind.com offer finest service of Accounting assignment help and Accounting homework help. Live tutors are available for 24x7 hours helping students in their Average Collection Period Ratio related problems. We provide step by step Average Collection Period Ratio question's answers with 100% plagiarism free content. We prepare quality content and notes for Average Collection Period Ratio topic under Accounting theory and study material. These are avail for subscribed users and they can get advantages anytime.

Why Expertsmind for assignment help

- Higher degree holder and experienced experts network

- Punctuality and responsibility of work

- Quality solution with 100% plagiarism free answers

- Time on Delivery

- Privacy of information and details

- Excellence in solving Accounting questions in excels and word format.

- Best tutoring assistance 24x7 hours