Working Capital

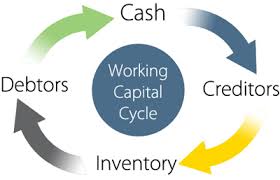

Working Capital is the amount required for meeting the daily expenses of the business. It measures the liquidity of the business operations.It is the difference between current assets and current liability. If current assets are more than current liability, it shows that company is having strong liquidity position whereas if current liability exceeds current assets, it shows working capital deficiency.It is the important tool to measure the operating and financial efficiency of the business.Deficiency in working capital may make business bankrupt.

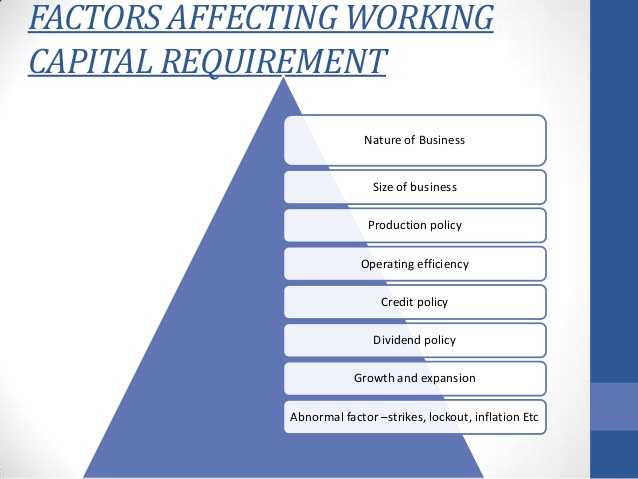

Factors affecting Working Capital

There are various factors affecting the composition of Working Capital are listed as follows:-

1 Availability of raw material Used and nature of finished goods

2 Type of Industry to which Entity Belongs

3 Competitiveness

4 Stages of Growth & Expansion

Conclusion

Working Capital is considered as the blood of the organization because efficiency of its operations is dependent on it. Working Capital is required for day to day operations of the business and thus it shall be effectively managed. Any mismanagement of working capital will lead to the inefficiency in operations and huge losses for the company. Thus, effective plans for the management of working capital shall be formulated for the business after consulting with top management and finance experts.