Global Financial Crisis

The global financial or economic crisis was a result of the erroneous housing loan systems where in the accreditation and credit valuations had several loopholes in them. The bursting of the housing loan bubble gravely impacted the American economy as well as Wall Street. If the rules and regulations

Intermediaries played an important role in causing, controlling and recovering from the crisis. Global financial crisis or sub-prime crisis shook the world as well as the financial markets. Thousands of people were out of the job because of the recession and the stock market went down tremendously.

Many of the American banks and firms became bankrupt because of the subprime crisis.

Effect of global financial crisis on stock market

With the increasing globalization and interconnection of the international stock market, the effect of one place affects the market across. As stock markets are open to foreign investors, there is a growth in liquidity and portfolio diversification.

The stock market was also at a boom and was liquid in nature. Many different portfolio were made in this respect. This created attractive opportunities for investment. So, the market of loan was growing at a fast pace.

The stock market slashed down, this crisis not only affected the US economy, but it also affected the world, there was a high time fall in the share prices of the shares of the companies. NADAQ, SENSEX, DOW JONES all the stock markets saw a fall. (Pagano, U. and Rossi, 2009)

With this the stock market was highly affected and the shares of the stocks fell down tremendously.There was a fall in the stock market worldwide. This crisis erased 4.5 trillion US dollars from the global market within four weeks of the crisis. There was a cumulative fall of more than 10% in the stock prices. Within a week, the Index fell down more than 10%.

The recent global financial crisis has brought into picture the effects as well as the limitations of the financial innovation and reducing its effect on the core benefits of the economy. The main reason behind the same is extensive use of different financial vehicles such as collateralized debt obligations (CDOs), credit default swaps (CDSs), securitization, which led to the crisis. We can say that the mortgage securitization was one of the financial innovations which were adopted by the countries to reduce the financial information, but this instrument did not help in reducing the informational problems pertaining to credit transactions, nor it worked as an appropriate risk assessment tool. (Beenstock, M, 2010)

In the crisis associated with the subprime mortgage market, Stiglitz (2009) contended "the current regulation and regulatory institutions failed" (p. 295). The mortgage crisis was characterized by the development of a housing bubble or the exaggerated appreciation of housing prices. Stiglitz made the Federal Reserve responsible for not taking policy action on the "over inflated housing prices" (p. 281). The housing bubble, identified by the ratio of mortgage payment to household income, became unsustainable when real estate prices increased and the income of mortgagors decreased.

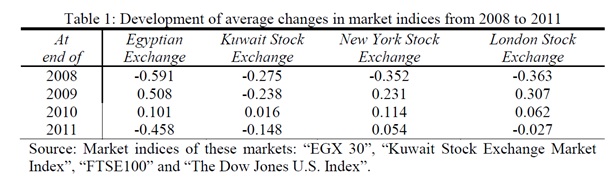

Table 1 shows that the average changes in the market indicies from 2008 to 2011, which was because of the financial crisis. Because of the financial crisis the stock market across the globe slashed down.

The global crisis ended in the loss of $4 trillion which was lost output and resulted in the loss of 28 million jobs along with the increased debt and deficits across the market. With the Euro zone crisis, the leaders focused on adopting G-20 action strategy as well as changes in the structural policies of IMF and monetary and trade policies which were also one of the biggest failures. The negotiations for the new trade policies also failed along with the failure in the delivery of the millennium development goals.

The world has become an extremely small place and the impact of an event in one place is greatly affecting the complete planet. The subprime crisis was one such economic event. The U.S mortgage market faced a fall down due to the failure and end of the process of securitization. This impacted eh complete financial market and led to an economic failure of a number of firms as well as businesses. People were no longer blessed with the economic boom and this should be understood by financial mangers (Kregel, J. 2009).

Conclusion

The stock market was highly affected by the subprime crisis, the stocks of all the major markets like London stock market, New York stock market, Australia stock market, European stock market and Asian stock markets were highly affected by the recession and the stock market and the prices of the stock splashed down tremendously.