1) Define demand elasticity and then explain cross, price and demand elasticity in decisions in management?

Demand elasticity: It measures the percentage change in quantity demanded for the percentage change in the factor affecting demand. The factor affecting demand can be price of the commodity, income of an individual, price of related commodity. Price elasticity of demand tells us the responsiveness of demand for a unit change in price. Similarly, income elasticity of demand tells us the responsiveness of demand for the change in income.

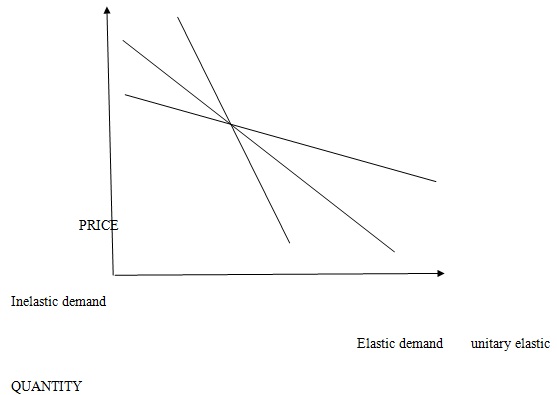

Elasticity can be of three types:

a) Elastic demand: When demand elasticity is greater than one it is said to be elastic. When the demand is elastic people are more responsive to change the demand of the product for a unit change in price. In this case a fall in price may lead to large increase in demand. Example of goods with elastic demand is coffee, tea.The extreme case of elastic demand is perfectly elastic demand.

b) Inelastic demand: When demand elasticity is less than one it is said to be inelastic. When the demand is inelastic people are less responsive to change the demand of the product for a unit change in price. In this case fall in price may not increase the demand by a much larger amount. Examples of goods with inelastic demand are basic necessities like water, electricity. An extreme case of inelastic demand is perfectly inelastic demand

Note: Examples of perfectly elastic/inelastic demand does not exist in the real world. They are rarely used in practical world.

c) Unitary elastic: When demand elasticity is equal to one it is said to be unitary elastic. In this case percentage change in quantity demanded is same as percentage change in price. Examples are those goods that are perfect substitutes (like in shoes one can be indifferent between Nike and Adidasif the price of any one of them rises consumers will shift to another brand).

QUANTITY

Cross price elasticity of demand: It measures the responsiveness of how demand of one good changes due to change in the prices of the related commodity. The related commodity can be substitutes or can be complements. Therefore, cross price elasticity measures how change in the prices of substitutes and complements affects the demand of commodity.

a) Substitute goods: Two goods are said to be substitutes if they can be used instead of each other. For example: In case of coffee one can drink cappuccino instead of latte keeping tastes, preferences and other things constant. A rise in the price of a substitute good will increase demand for our commodity as people will switch from substitute good to our commodity. So, the cross price elasticity will be positive in case of substitutes.

b) Complementary goods: Two goods are said to be complementary if they have to used jointly. For example: Car and petrol. In this case a rise in petrol price will lower its demand as well as demand for cars as people know that they can't drive cars without petrol. So the cross price elasticity in case of complements will be negative.

Use of Demand elasticity and cross price elasticity of demand in decision in management.

Demand elasticity has important implications in decision making in management. Firms has to first look at the elasticity of the product to study the impact of price change on the quantity demanded. The firms that don't take into consideration elasticities when they change the price of commodities can suffer huge losses. But these days most of the firms has a separate research department that studies the effect of changing prices on quantities.

Elasticity is important because it enables the firms to know what will be the change in quantity demanded due to change in prices. The firms should know about the products they are producing have elastic demand or inelastic demand. The firms that produces products that have elastic demand should know that when they increase the price, people will shift the demand to other products i.e. quantity demanded will fall leading to fall in total revenue of the firms keeping everything constant.

Firms that produces goods with inelastic demand can increase the prices without worrying much about the change in quantity demanded. In this case when firms increase the prices of commodities it is producing consumers will not change their demand by that extent thus increasing the total revenue of the firms. Therefore, for firms that have elastic demand cannot increase their prices since it may reduce its total revenue whereas firms with inelastic demand can increase their prices as it will increase their total revenue.

Now turning to cross price elasticities,suppose a firm produces commodities that have very close substitutes. Example: Colgate and Close up (toothpaste brands), Nescafe and Bru (coffee brands) are very close substitutes of each other. Let us assume that a firm producing Colgate increases the price of its product now the consumers will find Close up to be more than Colgate and will shift towards Close up. In this case Colgate has very high cross price elasticity of demand. Goods that are not close substitute (example: orange soft drink and lime soft drink) in this case people might be inclined towards one taste so it might not be easy for them to substitute each other. In case firms can increase the prices without having much effect on demand.

Now suppose firm is producing a commodity that is used as a complement with other good. Suppose the firm is producing complementary good for example: toothpaste and toothbrush. So a rise in price of toothbrush good decrease the demand of toothbrush as well decreases the demand of toothpaste also. (Assume people can switch to other brands of toothpaste and toothbrush). So the firm should take into consideration how increasing in price of one good can lower the demand of its other products as well.

Thus by studying the elasticities firms can make appropriate decisions that will not reduce the total revenue when its price changes. If the firms know that price of its substitute product is going to fall it will take appropriate decisions beforehand so that its revenue won't fall much. Thus cross price elasticity is itself an important phenomenon which helps the firms to determine how they should react in case of price change.